As expected, the Bank of Canada–satisfied with the sharp decline in recent inflation pressure–raised the policy rate by only 25 bps to 4.5%. Forecasting that inflation will return to roughly 3.0% later this year and to the target of 2% in 2024 is subject to considerable uncertainty.

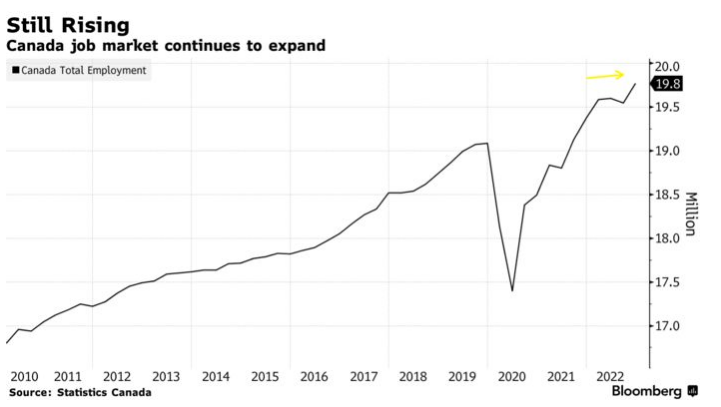

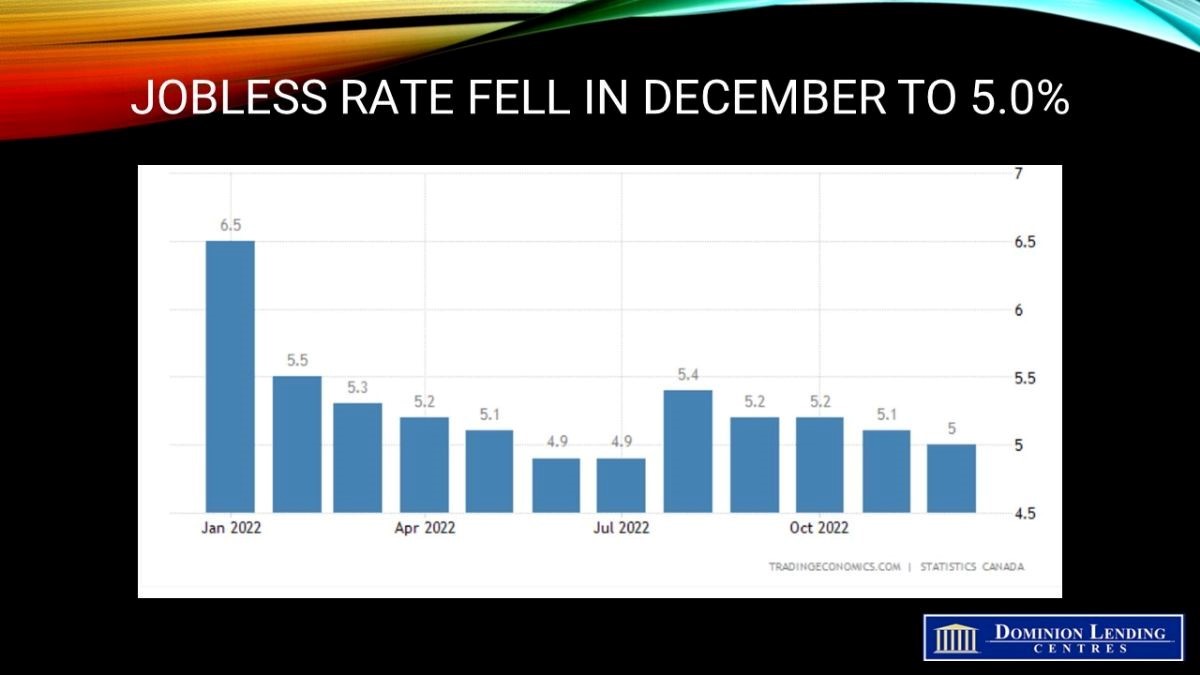

The Bank acknowledges that recent economic growth in Canada has been stronger than expected, and the economy remains in excess demand. Labour markets are still tight, and the unemployment rate is at historic lows. “However, there is growing evidence that restrictive monetary policy is slowing activity, especially household spending. Consumption growth has moderated from the first half of 2022 and housing market activity has declined substantially. As the effects of interest rate increases continue to work through the economy, spending on consumer services and business investment is expected to slow. Meanwhile, weaker foreign demand will likely weigh on exports. This overall slowdown in activity will allow supply to catch up with demand.”

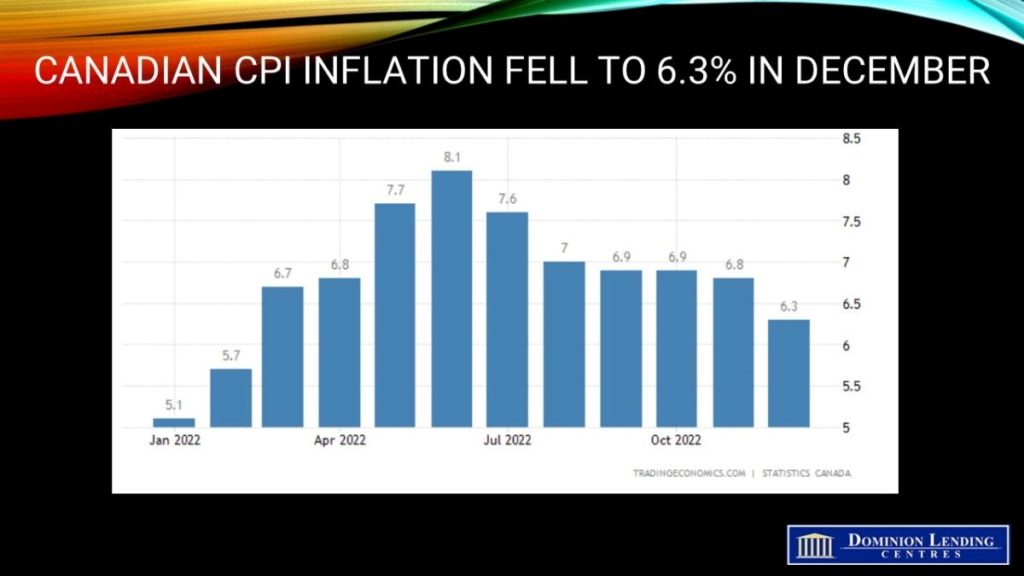

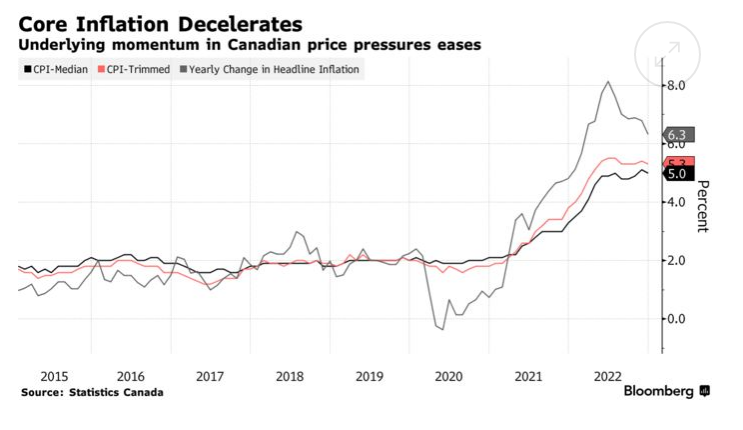

The report says, “Canada’s economy grew by 3.6% in 2022, slightly stronger than was projected in October. Growth is expected to stall through the middle of 2023, picking up later in the year. The Bank expects GDP growth of about 1% in 2023 and about 2% in 2024, little changed from the October outlook. This is consistent with the Bank’s expectation of a soft landing in the economy. Inflation has declined from 8.1% in June to 6.3% in December, reflecting lower gasoline prices and, more recently, moderating prices for durable goods.”

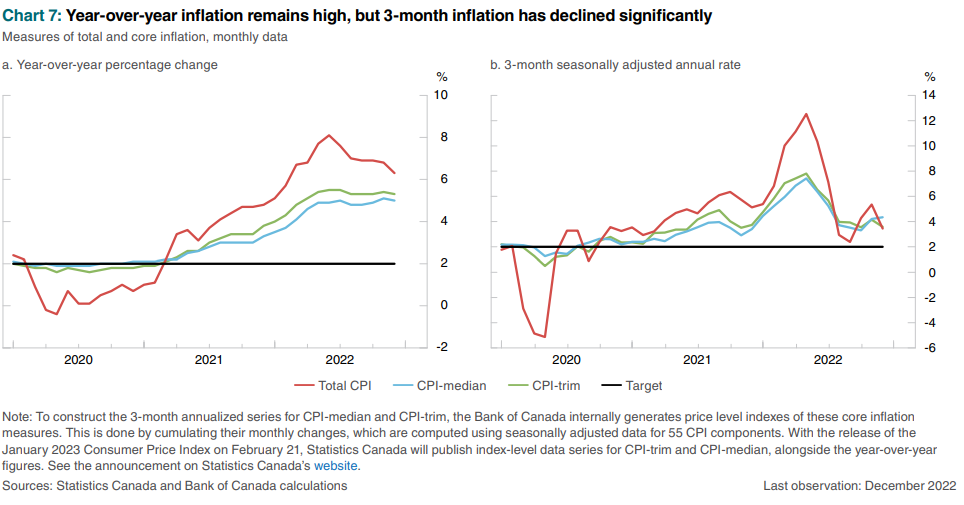

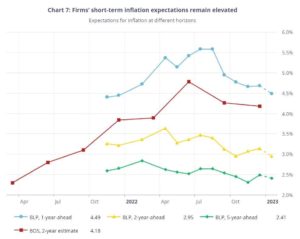

Short-term inflation expectations remain elevated. Year-over-year measures of core inflation are still around 5%, but 3-month measures of core inflation have come down, suggesting that core inflation has peaked.

The BoC says, “Inflation is projected to come down significantly this year. Lower energy prices, improvements in global supply conditions, and the effects of higher interest rates on demand are expected to bring CPI inflation down to around 3% in the middle of this year and back to the 2% target in 2024.” (the emphasis is mine.)

The Bank will continue its policy of quantitative tightening, another restrictive measure. The Governing Council expects to hold the policy rate at 4.5% while it assesses the cumulative impact of the eight rate hikes in the past year. They then say, “Governing Council is prepared to increase the policy rate further if needed to return inflation to the 2% target, and remains resolute in its commitment to restoring price stability for Canadians.”

Bottom Line

The Bank of Canada was the first major central bank to tighten this cycle, and now it is the first to announce a pause and assert they expect inflation to fall to 3% by mid-year and 2% in 2024.

No rate hike is likely on March 8 or April 12. This may lead many to believe that rates have peaked so buyers might tiptoe back into the housing market. This is not what the Bank of Canada would like to see. Hence OSFI might tighten the regulatory screws a bit when the April 14 comment period is over.

If you happen to be someone currently struggling with some post-holiday debt, that’s okay! Whether you’ve accumulated multiple points of debt from credit cards or are dealing with other loans (such as car loans, personal loans, etc.), you are likely looking for a way to simplify your payments – and reduce them. Rolling them into your mortgage could be the perfect solution.

If you happen to be someone currently struggling with some post-holiday debt, that’s okay! Whether you’ve accumulated multiple points of debt from credit cards or are dealing with other loans (such as car loans, personal loans, etc.), you are likely looking for a way to simplify your payments – and reduce them. Rolling them into your mortgage could be the perfect solution.