On April 18, Canada’s national banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), released its second Annual Risk Outlook (ARO), outlining what it believes are the most significant headwinds facing the Canadian financial system – and what the regulator plans on doing about it.

On April 18, Canada’s national banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), released its second Annual Risk Outlook (ARO), outlining what it believes are the most significant headwinds facing the Canadian financial system – and what the regulator plans on doing about it.

According to the report, the severe downturn in real estate prices and demand following their significant rise during the pandemic was the most pressing issue. OSFI acknowledges that the housing market changed significantly over the past year, and house prices fell substantially in 2022. The regulator is preparing for the possibility that the housing market will experience continued weakness throughout 2023.

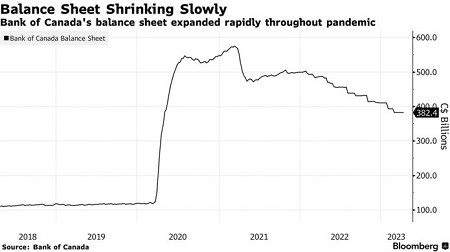

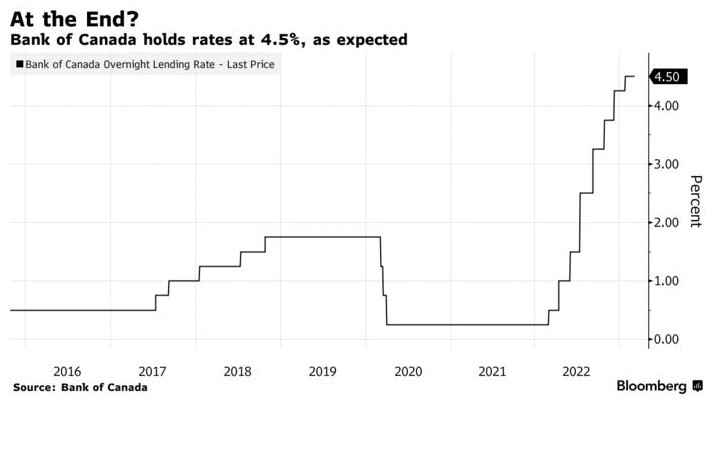

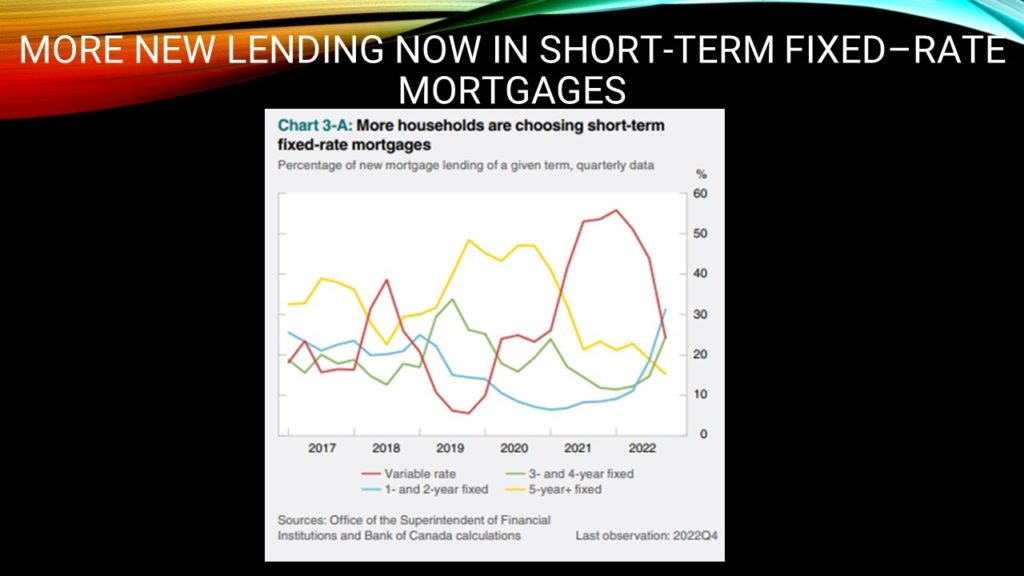

The report also highlights how the Bank of Canada’s rate hiking cycle has impacted borrowers’ ability to pay down mortgage debt, with the central bank increasing its benchmark cost of borrowing eight times between March 2022 and January 2023, bringing its Overnight Lending Rate from a pandemic low of 0.25% to 4.5% today.

Mortgage holders may be unable to afford continued increases in monthly payments or may experience a significant payment shock at the time of their mortgage renewal, leading to higher default probabilities. Given the considerable impact of real estate-secured lending (RESL) activities in the Canadian financial system, a housing market downturn remains a critical risk.

OSFI also highlights the dangers posed by more borrowers hitting their trigger rates; according to a National Bank study, eight in ten variable fixed-payment borrowers who took their mortgages out between 2020-2022 are impacted. Lenders have addressed this by extending the amortization period for affected borrowers, but OSFI says this is just a temporary solution.

Borrowers and lenders alike will need to pay the price in due course, as OSFI points out. The growth in highly leveraged borrowers increases the risk of weaker credit performance, potentially leading to more borrower defaults, a disorderly market reaction, and broader economic uncertainty and volatility.

These recent comments strengthen expectations that stricter mortgage rules could be in the cards before the year ends. Back in January, OSFI announced it was considering making tweaks to its Guideline B-20, which outlines borrowing and risk requirements for banks underwriting residential mortgages and qualification rules for borrowers, including the mortgage stress test.

OSFI may increase borrowers’ debt servicing ratio requirements, making it more challenging for those with larger debt loads to qualify for a mortgage. It is also considering limiting how many of these higher-leveraged borrowers banks can have in their portfolios, potentially leading to fewer borrowers making the cut at A-lenders and turning to the B-side and alternative mortgage market.

Finally, OSFI may change the threshold criteria for the mortgage stress test. Currently, borrowers must prove they can carry their mortgage at a rate of 5.25%, or 2% above the one they’ll receive from their lender, whichever is higher. However, following last year’s rapid rate increases, the 5.25% threshold has become obsolete, with all current market rates above 3.25%.

OSFI wrapped up consultations on these potential changes late last week and will release a report on its recommendations. Borrowers should keep an eye out for changes in the months to come.

Great News on the Inflation Front

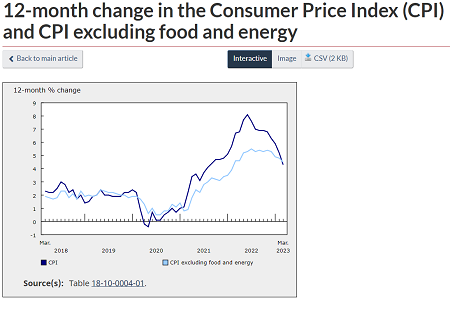

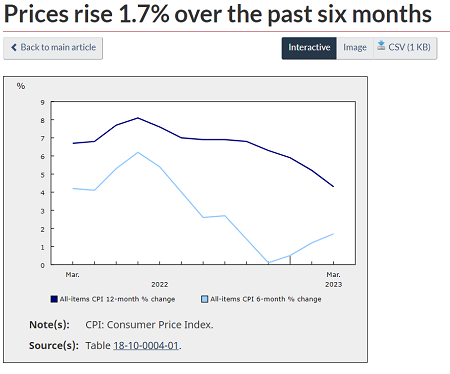

Great News on the Inflation Front On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was primarily due to a base-year effect, as furniture prices rose 8.2% month over month in March 2022 amid supply chain issues.

On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was primarily due to a base-year effect, as furniture prices rose 8.2% month over month in March 2022 amid supply chain issues. Bottom Line

Bottom Line The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

The Bank of Canada upgraded its growth projections for this year in a new forecast, suggesting the odds of a soft landing have increased. This may preclude interest rate cuts this year.

The Bank of Canada upgraded its growth projections for this year in a new forecast, suggesting the odds of a soft landing have increased. This may preclude interest rate cuts this year. This morning’s Jobs Report was again solid. Job creation, though more tempered than in earlier months, is still robust. The unemployment rate remained at 5.0% for the fourth consecutive month. Very troubling to the Bank of Canada was the wage inflation, still above 5%.

This morning’s Jobs Report was again solid. Job creation, though more tempered than in earlier months, is still robust. The unemployment rate remained at 5.0% for the fourth consecutive month. Very troubling to the Bank of Canada was the wage inflation, still above 5%. Are you looking to sell your home? We have a few tips to help you make the most of the spring season!

Are you looking to sell your home? We have a few tips to help you make the most of the spring season!