Good News on the Inflation Front Suggests Policy Rates Have Peaked

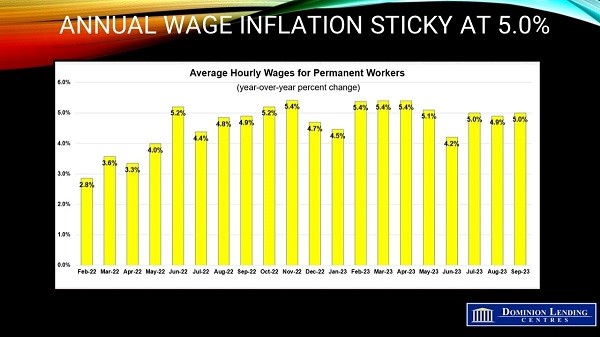

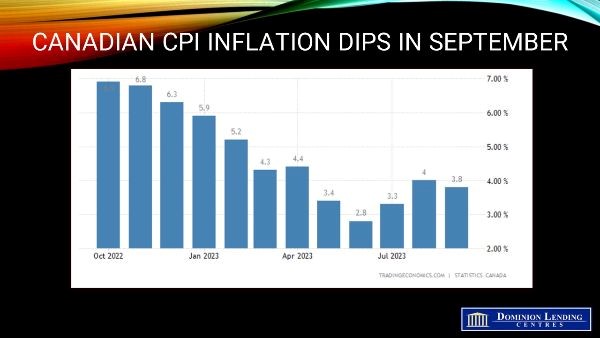

Today’s inflation report for September was considerably better than expected, ending the three-month rise in inflation. Not only did the headline inflation rate fall, but so did the core measures of inflation on a year-over-year basis and a three-month moving average basis. This, in combination with the weak Business Outlook Survey released yesterday, suggests that the overnight policy rate at 5% may be the peak in rates. While I do not expect the Bank to begin cutting rates until the middle of next year, the worst of the tightening cycle may well be over.

Offsetting the deceleration in the all-items CPI was a year-over-year increase in gasoline prices, which rose faster in September (+7.5%) compared with August (+0.8%) due to a base-year effect. Excluding gasoline, the CPI rose 3.7% in September, following a 4.1% increase in August. Looking ahead to the October inflation report, the base effect for headline CPI is favourable, as CPI surged in October 2022. Gasoline prices are down about 7% so far this month. Given the war in the Middle East, however, there is no guarantee that this will hold, but if it does, the October headline CPI could move into the low-3% range.

On a monthly basis, the CPI fell 0.1% in September after a 0.4% gain in August. The monthly slowdown was mainly driven by lower month-over-month prices for gasoline (-1.3%) in September. Goods inflation fell 0.3% from a month earlier, the first time since December 2022, and grew 3.6% from a year ago versus 3.7% in August. Services inflation was unchanged from August, the first time it hasn’t grown on a monthly basis since November 2021, while the rate slowed to 3.9% on a yearly basis, from 4.3% in August.

Yesterday’s Survey of Consumer Expectations showed that perceptions of current inflation remain well above actual inflation. One reason is the very visible level of grocery and gasoline prices. As the chart below shows, food inflation–though still elevated–decelerated to 5.9% last month, and CPI excluding food and energy fell to a cycle-low 2.8%. Large monthly gains in September 2022, when grocery prices increased at the fastest pace in 41 years, fell out of the 12-month movements and put downward pressure on the indexes.

Prices for durable goods rose at a slower pace year over year in September (+0.4%) compared with August (+1.4%). The purchase of new passenger vehicles index contributed the most to the slowdown, rising 1.7% year over year in September, following a 3.1% gain in August. The deceleration in the price of new passenger vehicles was partly attributable to improved inventory levels compared with a year ago.

Additionally, furniture prices (-4.6%) and household appliances (-2.3%) continued to decline year-over-year in September, contributing to the slowdown in durable goods. Consumers paid less on a year-over-year basis for air transportation (-21.1 %) in September, coinciding with a gradual increase in airline flights over the previous 12 months.

Other measures of core inflation followed by the Bank of Canada also decelerated.

Bottom Line

According to Bloomberg News calculations, “A three-month moving average of underlying price pressures that Governor Tiff Macklem has flagged as key to policymakers’ thinking fell to an annualized pace of 3.67%, from 4.29% a month earlier.” While this is still well above the Bank’s 2% target, the global economy is slowing, the Canadian and US economies are slowing, and with any luck at all, the Bank of Canada might see inflation move to within its target range next year. However, the central bank will be cautious, refraining from rate cuts until the middle of next year. The full impact of rate hikes has yet to be felt. The next move by the Bank of Canada could be a rate cut, but not until next year.

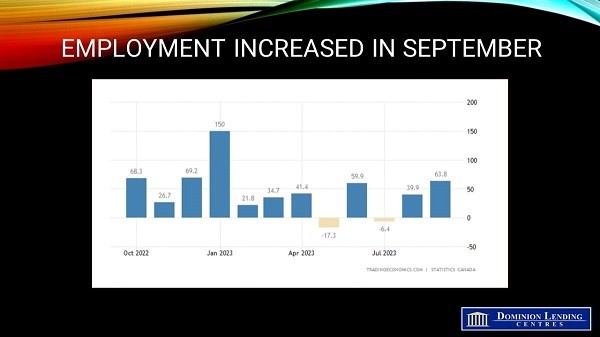

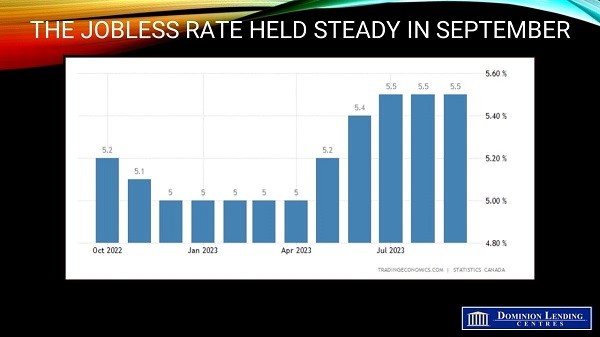

Canadian employment rose by a whopping 63,800 in September, tripling market expectations. The underlying data put the strong job growth into perspective. Most of the gains in overall employment were in part-time work, and total hours worked declined by 0.2%. Moreover, the unemployment rate held steady for the third consecutive month at 5.5% due to a surge in the labour force.

Canadian employment rose by a whopping 63,800 in September, tripling market expectations. The underlying data put the strong job growth into perspective. Most of the gains in overall employment were in part-time work, and total hours worked declined by 0.2%. Moreover, the unemployment rate held steady for the third consecutive month at 5.5% due to a surge in the labour force.