In life, things rarely go as planned. This is especially true when it comes to real estate! When it comes to buying a new home, in a perfect world, most of us would like to take possession of their new residence before having to move out of the old one. This makes moving a lot easier and allows you time for painting or renovations prior to moving into your new digs. Unfortunately, this is where things get complicated.

In life, things rarely go as planned. This is especially true when it comes to real estate! When it comes to buying a new home, in a perfect world, most of us would like to take possession of their new residence before having to move out of the old one. This makes moving a lot easier and allows you time for painting or renovations prior to moving into your new digs. Unfortunately, this is where things get complicated.

Most people need the money from the sale of their existing property to come up with the down payment for the new house. This is where bridge financing comes in. Essentially, bridge financing allows you to ‘bridge’ the financial gap between the firm sale of your current home and the firm commitment to purchasing your new home.

WHAT ARE BRIDGE LOANS?

Bridge loans are short-term solutions that range from 90 days to 12 months, with an average of six months in length. This type of financing allows you to access some of the equity in your existing property, to put towards the down payment of your new home. However, to be eligible for a bridge loan, a firm sale agreement MUST be in place on your existing home, meaning all subjects have been removed. You will also require a purchase agreement for the new home to verify the amount required.

If you have not yet sold your home, you will not be eligible for bridge financing as the lender needs that to accurately calculate how much equity you have available and if you can afford your new home.

If you are currently looking to sell, or are in the midst of selling your home and considering bridge financing, it is important to understand that unless you can qualify and pay for two mortgages, you should always sell your existing home before purchasing a new one. There are a couple reasons for this:

- Property values are constantly changing. You won’t know how much money you have until you sell your home as a home is only worth what someone is willing to pay for it NOW. Past sales and future guesses don’t count!

- You need the proceeds from your existing home to help pay for the down payment on your new home, as well as renovations, moving costs and (if required) the size of mortgage you qualify for.

However, if you have firm sale and purchase agreements in place and are adamant about bridge financing, there are some things you should know.

getting bridge financing

If you have sold your existing home but the closing date comes after the closing date of the new property you just purchased, then bridge financing will likely be your best option.

Remember – in order to qualify you must have a firm sale agreement for your current home and a purchase agreement for the new home. If you don’t have a firm selling date you may need to consider a private lender for the bridge loan.

If you do have firm sale and purchase agreements and want to move forward with bridge financing, you also need to consider the lender. Your new lender may not allow for bridge financing as not all lenders do. It is important to consider whether or not you think you need bridge financing so you can ensure you sign with the appropriate lender. Utilizing a Dominion Lending Centres mortgage broker can help you find a lender that provides the options you need.

COSTS OF BRIDGE FINANCING

It is important to mention that bridge financing typically costs MORE than your traditional mortgage. It is best to expect the Prime Rate plus 2, 3 or 4 percent, as well as an administration fee.

Also, in some cases, if you require a loan over $200,000 or a loan for more than 120 days, your lender may register a lien on the property until the loan is repaid. In order to remove this lien, you will need to consider the added costs of paying for a real estate lawyer.

PRIVATE FINANCING

If you have purchased your new home and are closing the deal, but your existing home has not yet sold, you would not qualify for bridge financing and would therefore need to consider a private loan.

Private financing is expensive, but it is generally a more affordable option versus lowering the asking price of your existing home and losing out on tens of thousands just to sell quickly. Seeking out a specialized mortgage broker who has access to individuals that lend money out privately to get the best rate and terms available to you.

COSTS OF PRIVATE FINANCING

Private loans are dependent on having enough equity in your current property to qualify and are more expensive than traditional mortgages. Private loans have a much higher interest rate than traditional mortgages, which averages anywhere from 7-15 percent. The costs associated with a higher interest rate is in addition to an up-front lender fee and potential broker fee. These amounts will vary based on your specific situation with consideration to: time required for the loan, the loan amount, loan-to-value ratio, credit bureau, property location, etc.

When it comes to bridge financing and selling and buying of your home, don’t waste your time trying to figure it out on your own. Give us a call and we can help you determine your best option!

Spring is here and that means we’re embarking on the best time to start getting outside and enjoy more of what the beautiful outdoors has to offer. From weekend hikes, to community running events, don’t underestimate the power of a quick ‘at-home workout’ to compliment leg, ankle, and core strengthening before you hit the trails. With no need for any equipment, all this Mandy Gill APP workout calls for is 20 minutes on the clock.

Spring is here and that means we’re embarking on the best time to start getting outside and enjoy more of what the beautiful outdoors has to offer. From weekend hikes, to community running events, don’t underestimate the power of a quick ‘at-home workout’ to compliment leg, ankle, and core strengthening before you hit the trails. With no need for any equipment, all this Mandy Gill APP workout calls for is 20 minutes on the clock. So, you are looking to purchase a second property! Congratulations! This is a great opportunity for you to expand your financial portfolio and ensure stability for the future. However, before you launch into this purchase there are a few things you should know, depending on which type of second property you are looking to purchase.

So, you are looking to purchase a second property! Congratulations! This is a great opportunity for you to expand your financial portfolio and ensure stability for the future. However, before you launch into this purchase there are a few things you should know, depending on which type of second property you are looking to purchase. While home inspections might not be the most exciting part of your home buying journey, they are extremely important and can save you money and a major headache in the long run.

While home inspections might not be the most exciting part of your home buying journey, they are extremely important and can save you money and a major headache in the long run. Let’s face it, mere mention of the word “money” can make people shift in discomfort. In an era in which the veils are being lifted off many societal taboos, a shroud of shame hangs stubbornly over money talk – we’re taught to fear it, we’re taught it’s too complicated, and those are all messages meant to disempower.

Let’s face it, mere mention of the word “money” can make people shift in discomfort. In an era in which the veils are being lifted off many societal taboos, a shroud of shame hangs stubbornly over money talk – we’re taught to fear it, we’re taught it’s too complicated, and those are all messages meant to disempower. The notion that we should be mortgage-free is a focus many of us strive to achieve the moment we realize the dream of homeownership. But, the fact is, many outstanding expenses and debts could be powered down faster – and more economically – by tapping into your home equity with a CHIP Reverse Mortgage.

The notion that we should be mortgage-free is a focus many of us strive to achieve the moment we realize the dream of homeownership. But, the fact is, many outstanding expenses and debts could be powered down faster – and more economically – by tapping into your home equity with a CHIP Reverse Mortgage. When it comes to finding your perfect home, there are so many more options for potential homeowners! From a single-family dwelling to a townhouse to a modular home, the choices are seemingly endless. But, before you start widening your search, let’s take a look at what makes these home types different – and which one is perfect for you!

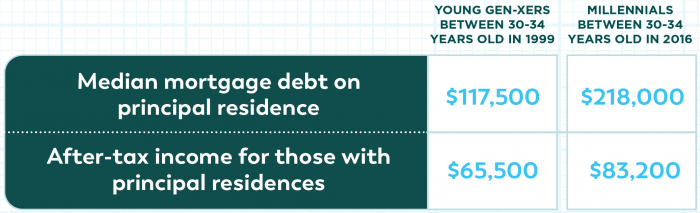

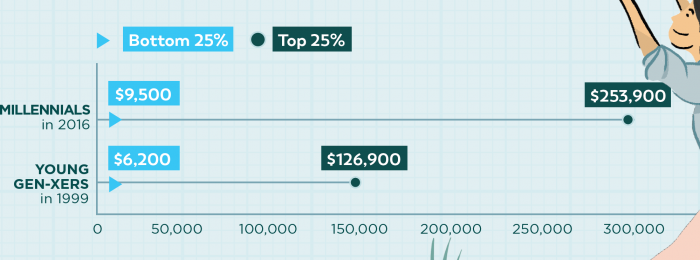

When it comes to finding your perfect home, there are so many more options for potential homeowners! From a single-family dwelling to a townhouse to a modular home, the choices are seemingly endless. But, before you start widening your search, let’s take a look at what makes these home types different – and which one is perfect for you! Are millennials better or worse off than Gen-Xers at the same age?

Are millennials better or worse off than Gen-Xers at the same age?

The winter holiday season is often said to be the most wonderful time of the year. However, it is also one of the busiest and most stressful times of the year. There are increased demands at work or in your business. The holidays tend to be socially demanding too. With all this going on at work and in your personal life, it can be very emotionally draining. This time of year is often centered on celebration, family, and friends. The fact is some people find themselves mired in family conflict or feeling lonely, heightening their levels of emotional stress.

The winter holiday season is often said to be the most wonderful time of the year. However, it is also one of the busiest and most stressful times of the year. There are increased demands at work or in your business. The holidays tend to be socially demanding too. With all this going on at work and in your personal life, it can be very emotionally draining. This time of year is often centered on celebration, family, and friends. The fact is some people find themselves mired in family conflict or feeling lonely, heightening their levels of emotional stress. Be mindful with money this season! Along with holiday joy come holiday bills, to avoid a sleigh-size tab, plan ahead to save money and maximize the payoff.

Be mindful with money this season! Along with holiday joy come holiday bills, to avoid a sleigh-size tab, plan ahead to save money and maximize the payoff.