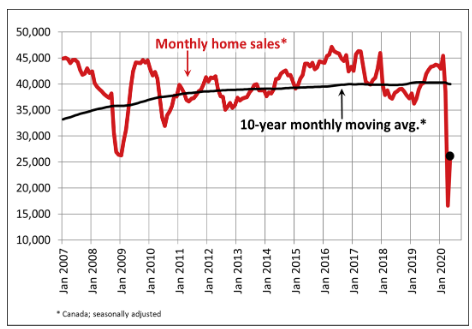

Today’s release of September housing data by the Canadian Real Estate Association (CREA) shows national home sales rose 0.9% on a month-over-month (m-o-m) (see chart below). This continues the rebound in housing that began five months ago amid record-tight market conditions.

“Along with historic supply shortages in a number of regions, fierce competition among buyers has been putting upward pressure on home prices. Much of that was pent-up demand from the spring that came forward as our economies opened back up over the summer,” said Costa Poulopoulos, Chair of CREA.

According to Shaun Cathcart, CREA’s Senior Economist, “Reasons have been cited for this – pent-up demand from the lockdowns, Government support to date, ultra-low interest rates, and the composition of job losses to name a few. I would also remind everyone that sales were almost setting records and markets were almost this tight back in February so we were already close to where things are now, as far away from Goldilocks territory as we had ever been before. But I think another wildcard factor to consider, which has no historical precedent, is the value of one’s home during this time. Home has been our workplace, our kids’ schools, the gym, the park and more. Personal space is more important than ever.”

The modest uptick in home sales nationally reflected diverse results regionally with about 60% of local markets seeing gains. Increases in Ottawa, Greater Vancouver, Vancouver Island, Calgary and Hamilton-Burlington sales were mostly offset by declines in the Greater Toronto Area (GTA) and Montreal; although, activity in the two largest Canadian markets is still historically very strong.

Actual (not seasonally adjusted) sales activity posted a 45.6% y-o-y gain in September. It was a new record for the month of September by a margin of 20,000 transactions, the equivalent of a normal month of September with an entire month of December tacked on. Sales activity was up in almost all Canadian housing markets on a year-over-year basis.

The number of newly listed homes declined by 10.2% in September, reversing the surge to record levels seen August. New supply was down in two-thirds of local markets, led by declines in and around Vancouver and the GTA.

With sales edging up in September and new supply dropping back, the national sales-to-new listings ratio tightened to 77.2% – the highest in almost 20 years and the third-highest monthly level on record for the measure.

Based on a comparison of sales-to-new listings ratio with long-term averages, about a third of all local markets were in balanced market territory, measured as being within one standard deviation of their long-term average. The other two-thirds of markets were above long-term norms, in many cases well above.

There were just 2.6 months of inventory on a national basis at the end of September 2020 – the lowest reading on record for this measure. At the local market level, a number of Ontario markets are now into weeks of inventory rather than months. Much of the province of Ontario is close to or under one month of inventory.

Home Prices

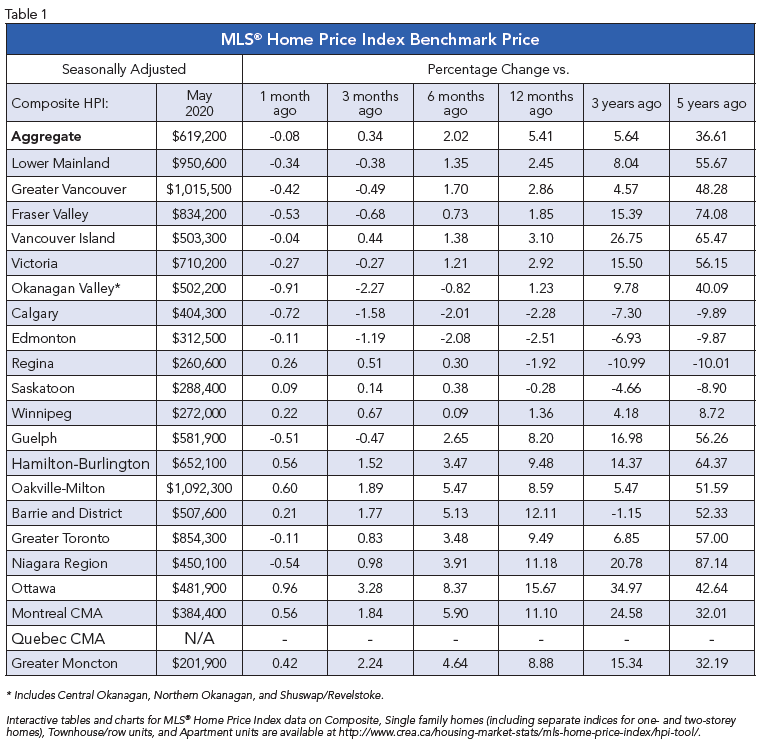

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose by 1.3% m-o-m in September 2020. Of the 39 markets now tracked by the index, all but two were up between August and September.

As buyers are moving further away from city centres, CREA added a large number of Ontario markets to the MLS® HPI this month. The list includes Bancroft and Area, Brantford Region, Cambridge, Grey Bruce Owen Sound, Huron Perth, Kawartha Lakes, Kitchener-Waterloo, the Lakelands (Muskoka-Haliburton-Orillia-Parry Sound), London & St. Thomas, Mississauga, North Bay, Northumberland Hills, Peterborough and the Kawarthas, Quinte & District, Simcoe & District, Southern Georgian Bay, Tillsonburg District and Woodstock-Ingersoll.

The non-seasonally adjusted Aggregate Composite MLS® HPI was up 10.3% on a y-o-y basis in September – the biggest gain since August 2017. The largest y-o-y gains in the 22-23% range were recorded in Bancroft and Area, Quinte & District, Ottawa and Woodstock-Ingersoll.

This was followed by y-o-y price gains in the range of 15-20% in Barrie, Hamilton, Niagara, Guelph, Brantford, Cambridge, Grey Bruce-Owen Sound, Huron Perth, the Lakelands, London & St. Thomas, North Bay, Simcoe & District, Southern Georgian Bay, Tillsonburg District and Montreal.

Prices were up in the 10-15% range compared to last September in the GTA, Oakville-Milton, Kawartha Lakes, Kitchener-Waterloo, Mississauga, Northumberland Hills, Peterborough and the Kawarthas, and Greater Moncton.

Meanwhile, y-o-y price gains were around 5% in Greater Vancouver, the Fraser Valley, the Okanagan Valley, Regina, Saskatoon and Quebec City. Gains were about half that in Victoria and elsewhere on Vancouver Island, as well and in St. John’s, and prices were more or less flat y-o-y in Calgary and Edmonton.

The actual (not seasonally adjusted) national average home price set another record in September 2020, topping the $600,000 mark for the first time ever at more than $604,000. This was up 17.5% from the same month last year.

Bottom Line

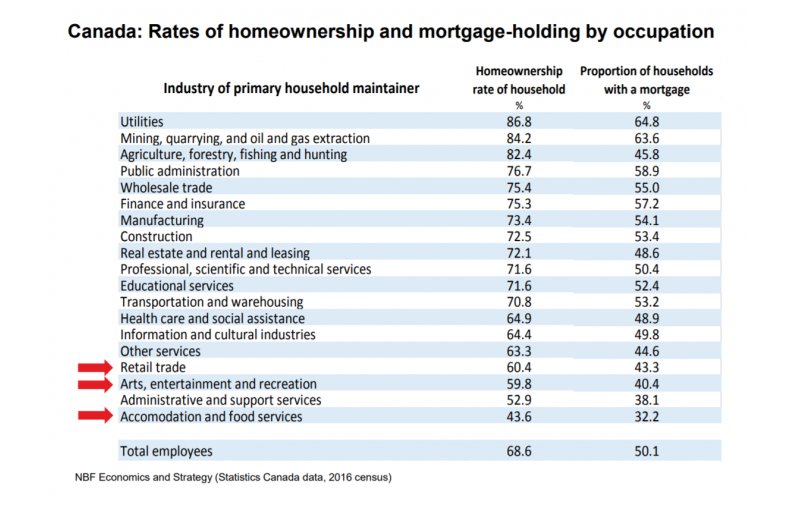

Housing strength is largely attributable to record-low mortgage rates and pent-up demand by households that have maintained their level of income during the pandemic. The hardest-hit households are low-wage earners in the accommodation, food services, and travel sectors. These are the folks that can least afford it and typically are not homeowners.

The good news is that the housing market is contributing to the recovery in economic activity.