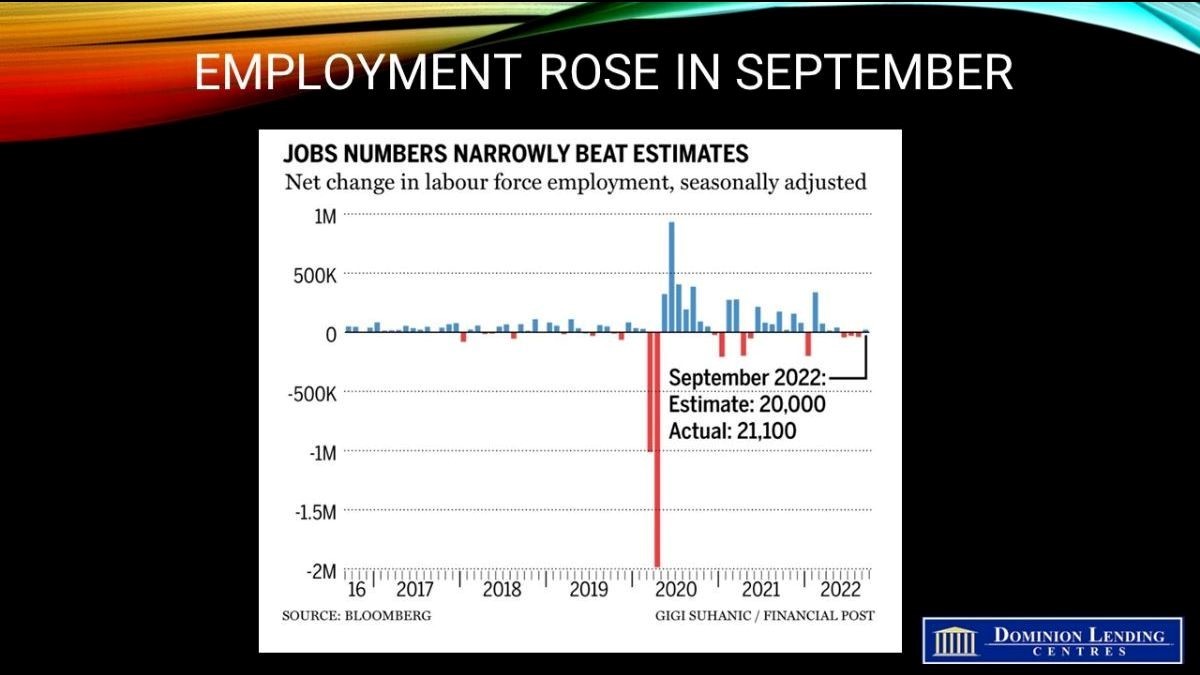

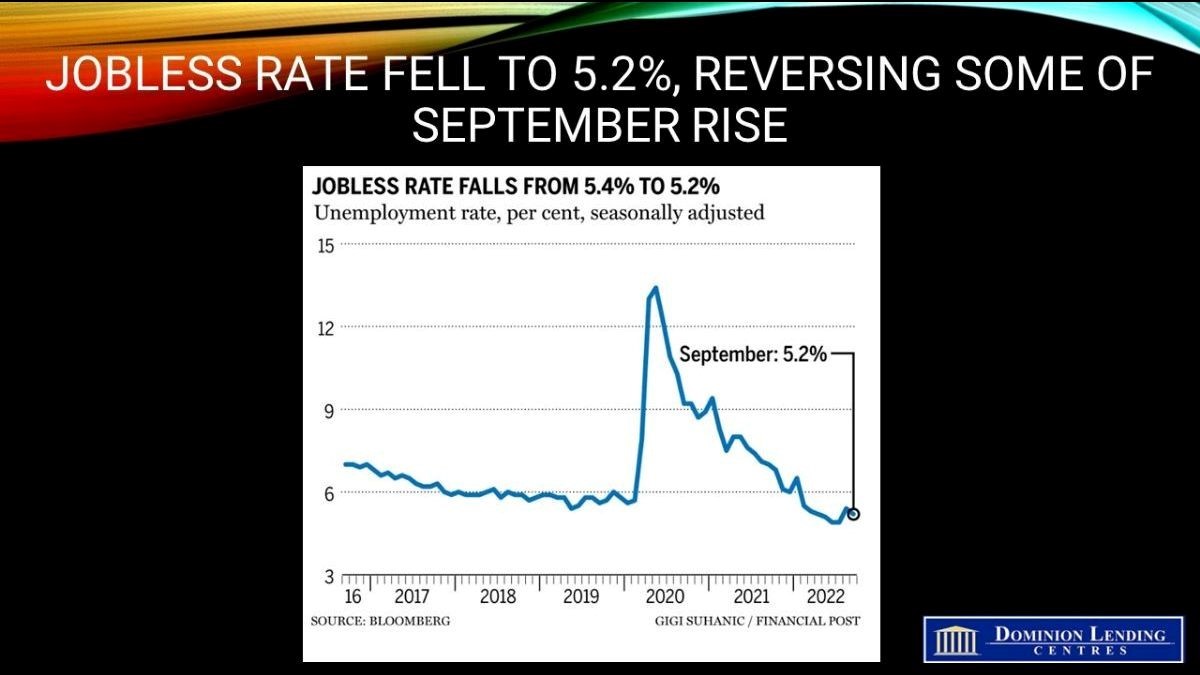

Today’s Labour Force Survey showed that employment grew in September for the first time in four months. Job gains remained moderate despite the high number of vacancies, indicating how tight the job market remains. Wage rates rose 5.2% year-over-year (y/y), the fourth consecutive month for which wage gains exceeded 5%. The jobless rate ticked downward, retracing some of the rise posted in August.

Canada added just over 21,000 jobs last month, with both full-time and part-time work increasing. Gains in educational services, health care, and social assistance were offset by losses in manufacturing; information, culture and recreation; transportation and warehousing, and public administration.

Employment increased in four provinces, led by British Columbia, while fewer people were working in Ontario and Prince Edward Island.

Total hours worked were down 0.6% in September 2022. Despite declining by 1.1% since June, total hours worked were up 2.4% y/y.

In separate news, the US employment data for September was also released today, showing a moderate dip in job growth from the August data, although the gains remained strong. The jobless rate fell to 3.5% from 3.7% a month earlier. The persistent strength in hiring underscored the challenges facing the Federal Reserve as it tries to curtail job growth enough to tame inflation.

Bottom Line

Today’s labour force data in Canada and the US do nothing to deter the central banks from their rate-hiking paths. This is the last employment report before their decision dates–October 26th for the Bank of Canada and November 2nd for the Fed–although we will see the release of inflation and housing data before they meet again. It is already baked into the cake that rate hikes will continue.

Both central banks recently cautioned against market expectations that the fight against inflation was nearly over. Today’s data reinforce what we have already been told.

Dr. Sherry Cooper

Chief Economist | Dominion Lending Centres