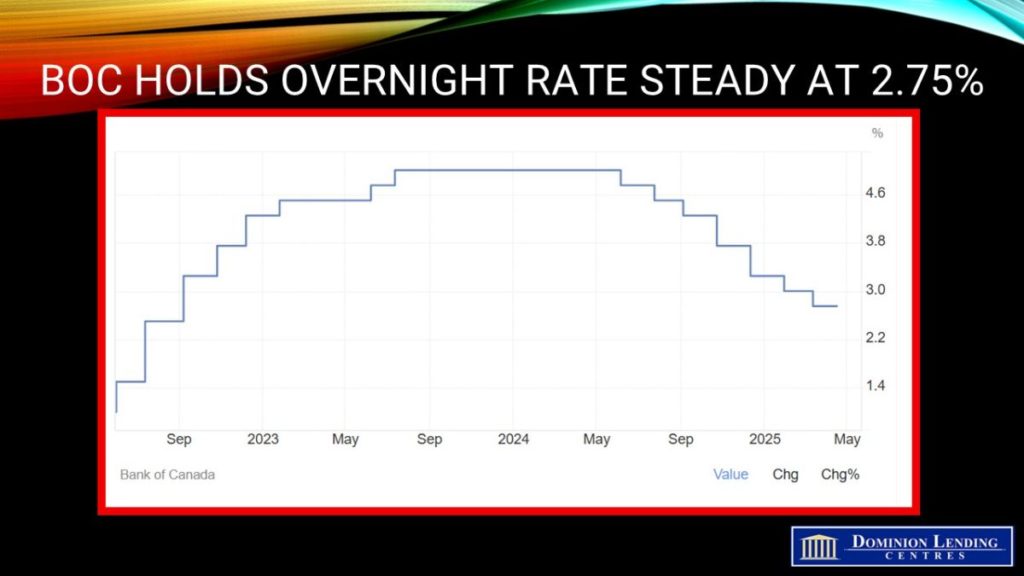

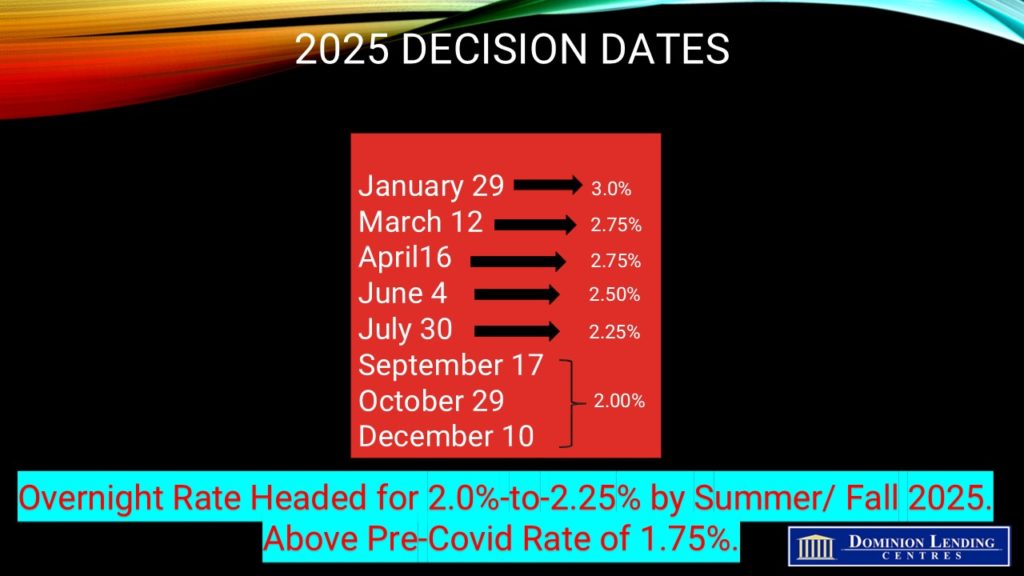

The Bank of Canada held its benchmark interest rate unchanged at 2.75% at today’s meeting, as expected by half of the market, to mark the first hold following 225 basis points of cuts in seven consecutive decisions. The governing council noted that the unpredictability of the magnitude and duration of tariffs posed downside risks to growth and lifted inflation expectations, warranting caution regarding the continuation of monetary easing.

The higher uncertainty stemmed from the United States’ lack of a clear tariff path, prompting the BoC Governing Council to present two economic scenarios in its latest Monetary Policy Report. Should the US limit the scope of its tariffs on Canada, the BoC expects growth to temporarily weaken and inflation to hold near the 2% target. Should the US proceed with an all-out trade war with Canada and China, the BoC has pencilled in a recession this year, and inflation rising temporarily above 3% next year.

Of course, as the Bank stated in its press release, “Many other trade policy scenarios are possible. There is also an unusual degree of uncertainty about the economic outcomes within any scenario, since the magnitude and speed of the shift in US trade policy are unprecedented.”

The statement says, “Serial tariff announcements, postponements, and continued threats of escalation have roiled financial markets. This extreme market volatility is adding to uncertainty. Oil prices have declined substantially since January, mainly reflecting weaker prospects for global growth. Canada’s exchange rate has recently appreciated as a result of broad US dollar weakness.”

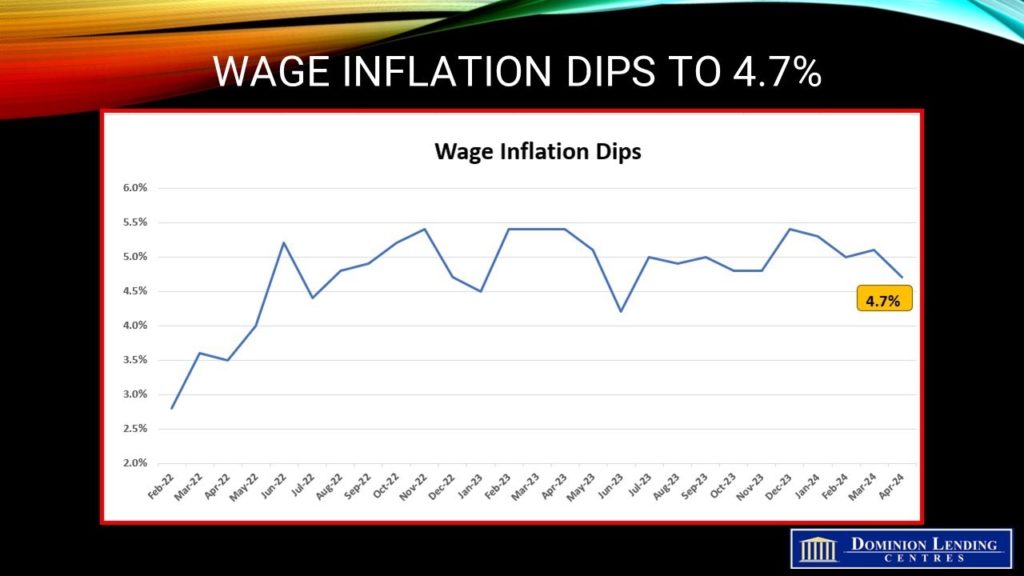

The Bank says in these very unusual times, “In Canada, the economy is slowing as tariff announcements and uncertainty pull down consumer and business confidence. Consumption, residential investment and business spending all look to have weakened in the first quarter. Trade tensions are also disrupting recovery in the labour market. Employment declined in March and businesses are reporting plans to slow their hiring. Wage growth continues to show signs of moderation.

Inflation was 2.3% in March, lower than in February but still higher than 1.8% at the time of the January Monetary Policy Report (MPR). The higher inflation in the last couple of months reflects some rebound in goods price inflation and the end of the temporary suspension of the GST/HST. Starting in April, CPI inflation will be pulled down for one year by the removal of the consumer carbon tax. Lower global oil prices will also dampen inflation in the near term. However, we expect tariffs and supply chain disruptions to push up some prices. How much upward pressure this puts on inflation will depend on the evolution of tariffs and how quickly businesses pass on higher costs to consumers. Short-term inflation expectations have moved up, as businesses and consumers anticipate higher costs from trade conflict and supply disruptions. Longer-term inflation expectations are little changed.

Governing Council will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs. Our focus will be on ensuring Canadians continue to have confidence in price stability through this period of global upheaval. This means we will support economic growth while ensuring that inflation remains well-controlled.

The Governing Council will proceed carefully, paying particular attention to the risks and uncertainties facing the Canadian economy. These include the extent to which higher tariffs reduce demand for Canadian exports, how much this spills over into business investment, employment, and household spending, how much and how quickly cost increases are passed on to consumer prices, and how inflation expectations evolve.

Monetary policy cannot resolve trade uncertainty or offset the impacts of a trade war. What it can and must do is maintain price stability for Canadians.”

Bottom Line

The US is determined to impose worldwide tariffs, disproportionately hitting Canada, Mexico, and China, the US’s top trading partners. This is a misguided neo-Mercantilist policy. Mercantilism assumes that the global economic pie is fixed, so if one country prospers, another must fail. This idea of a zero-sum game was debunked in the 18th century by Adam Smith and others who showed that if countries have a competitive advantage in various products and services, all are better off by producing and trading those products with the rest of the world. It is not a zero-sum game. The economic pie grows with trade. This was the idea behind globalization and the USMCA free trade agreement.

Given Canada’s vulnerability to tariffs, the economy will suffer more than the US, which has a relatively closed economy (where exports are a small proportion of GDP). Prices will rise depending on the duration and size of the coming tariffs, but mitigating the inflation will be the weakness in economic activity. Stagflation, a buzzword from the 1970s, is back in the lexicon.

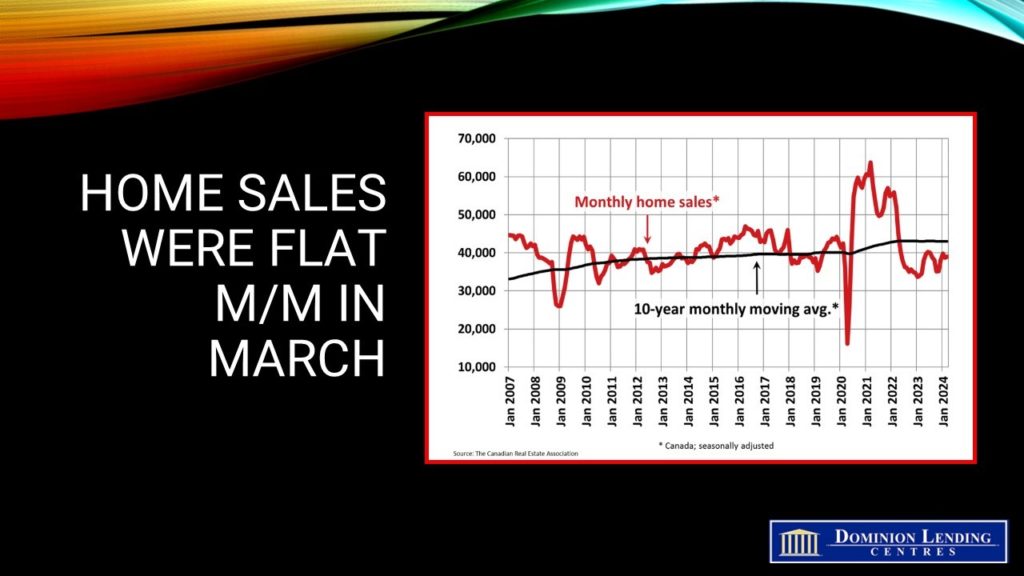

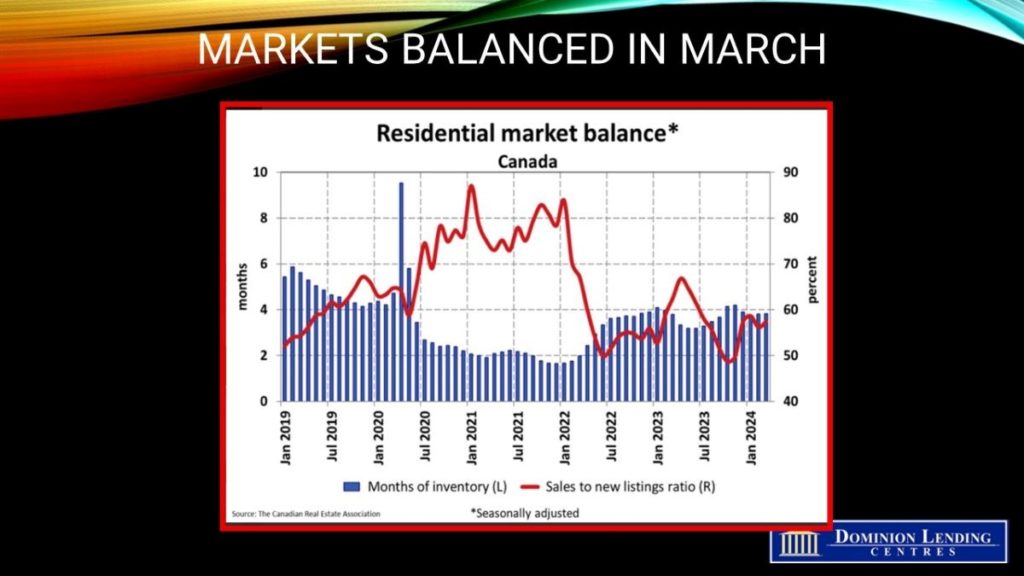

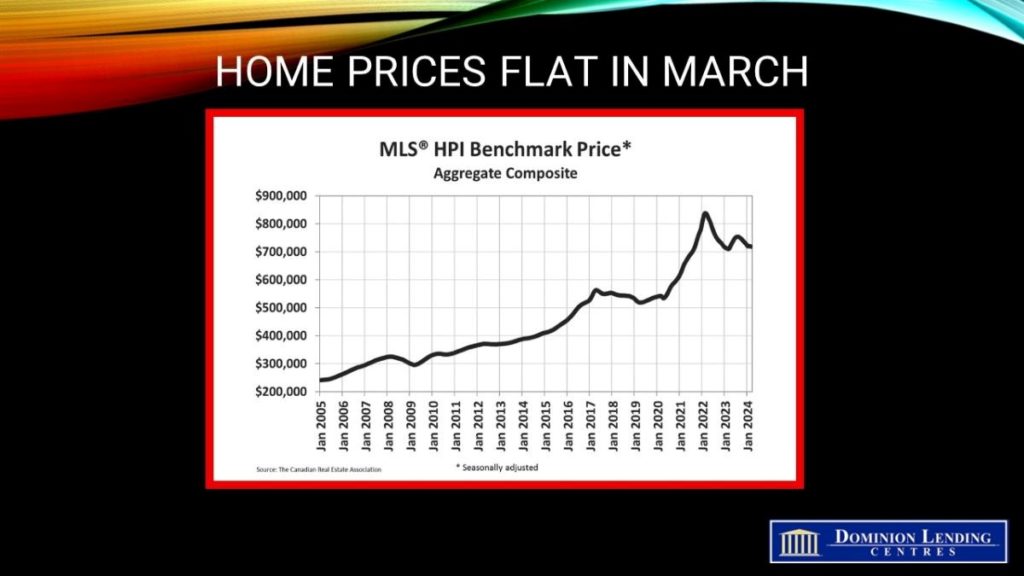

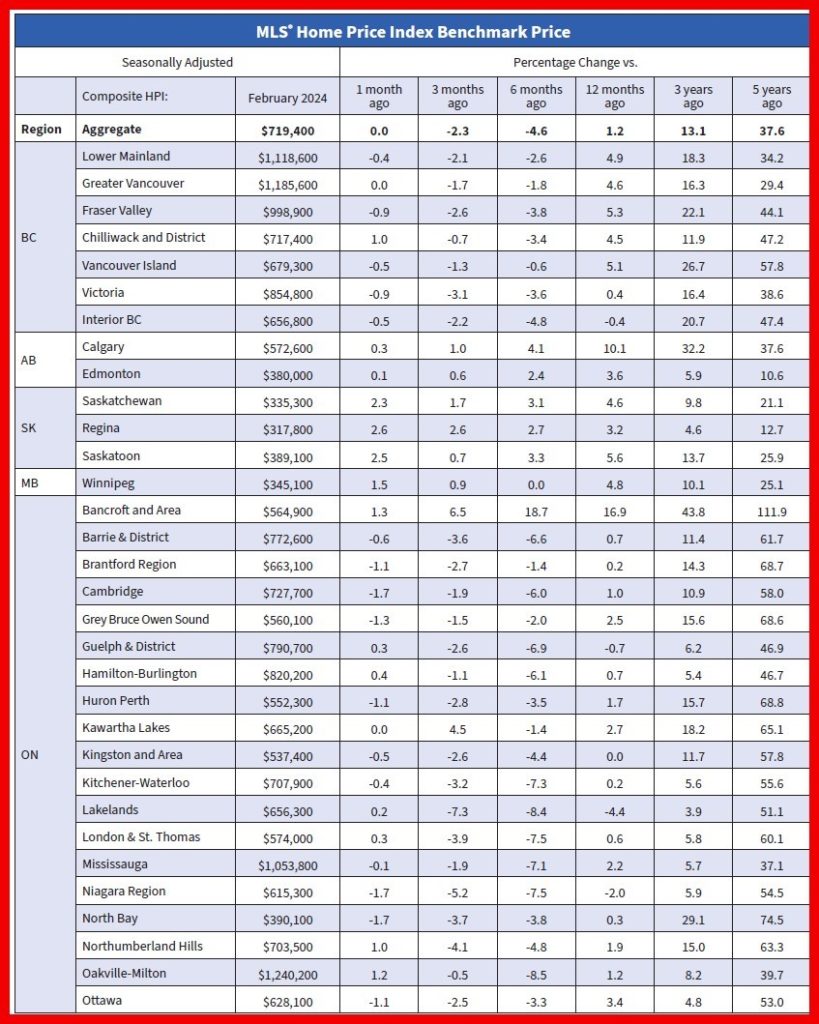

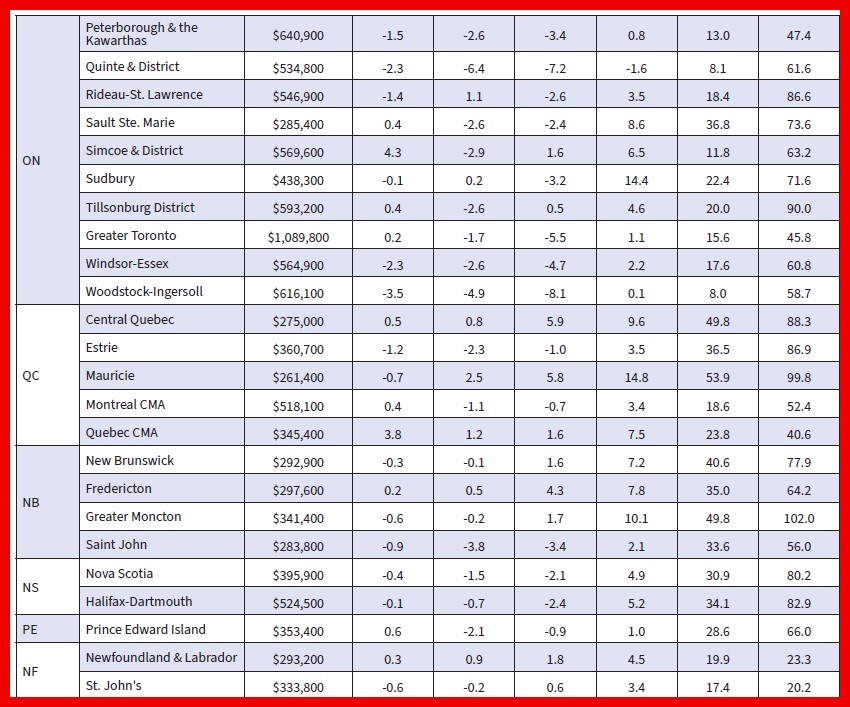

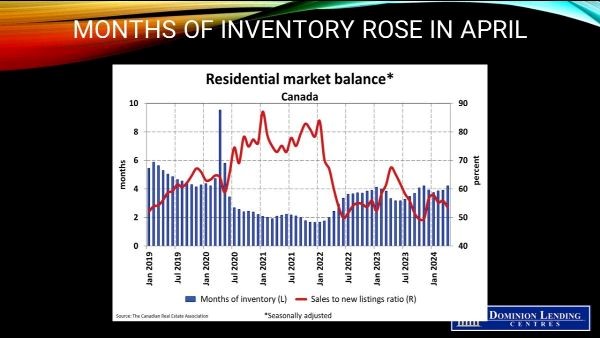

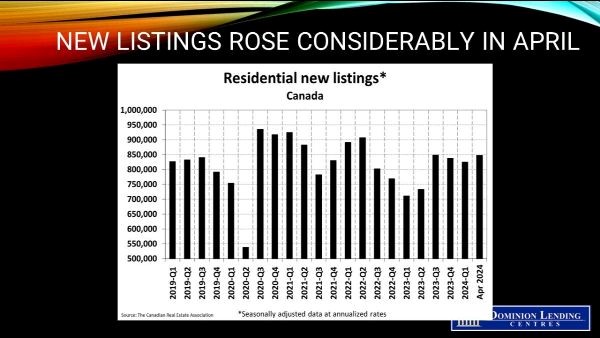

We expect the BoC to resume cutting the policy rate in 25-bps increments until it reaches 2.0%-to-2.25% this summer, triggering a rebound in home sales. Layoffs and spending cuts will dampen sentiment, but lower interest rates will bring buyers off the sidelines. Housing inventories have risen sharply with new condo supply and a marked rise in the new listings of existing homes, and home prices are falling.

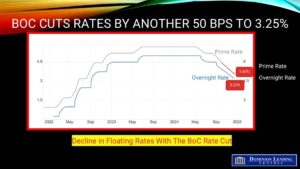

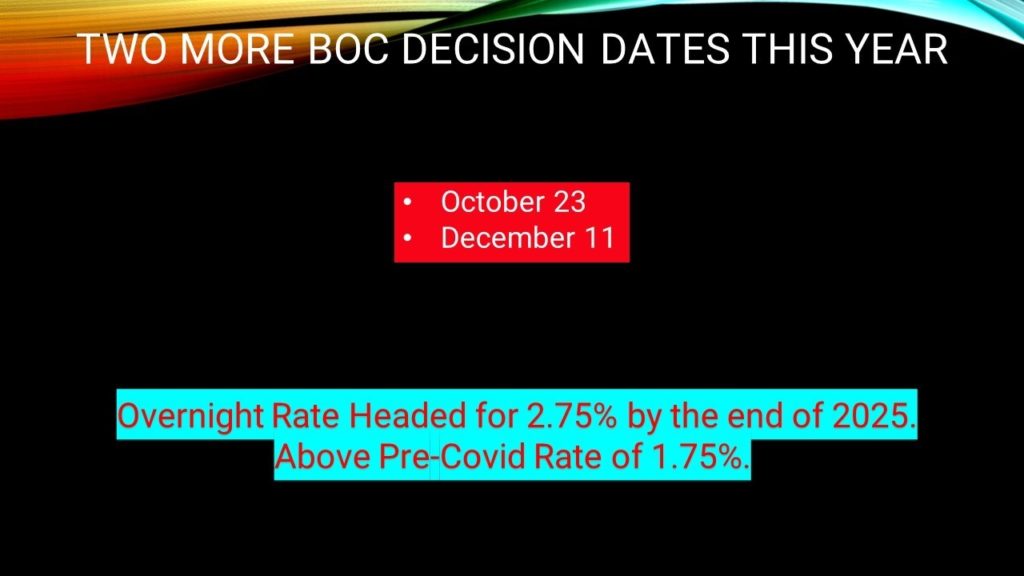

The BoC slashed the overnight rate by 50 bps this morning, bringing the policy rate down to 3.25%. The market had priced in nearly 90% odds of a 50 bp move, where consensus coalesced. The combined slower-than-expected GDP growth and a sharp rise in the Canadian unemployment rate to 6.8% triggered the Bank’s second consecutive jumbo rate cut. Today’s move will take the prime rate down 50 bps to 5.45% effective tomorrow, reducing floating rate mortgage loan rates by a half point, easing the cost of borrowing and reducing the monthly payment increase for renewals. This should spark housing activity, which accelerated in October and November.

The BoC slashed the overnight rate by 50 bps this morning, bringing the policy rate down to 3.25%. The market had priced in nearly 90% odds of a 50 bp move, where consensus coalesced. The combined slower-than-expected GDP growth and a sharp rise in the Canadian unemployment rate to 6.8% triggered the Bank’s second consecutive jumbo rate cut. Today’s move will take the prime rate down 50 bps to 5.45% effective tomorrow, reducing floating rate mortgage loan rates by a half point, easing the cost of borrowing and reducing the monthly payment increase for renewals. This should spark housing activity, which accelerated in October and November.

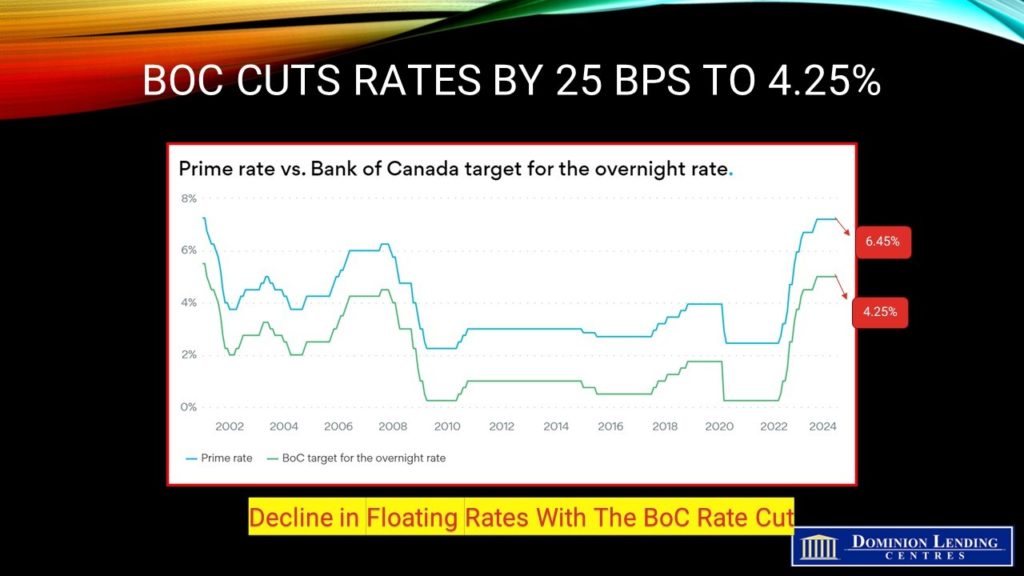

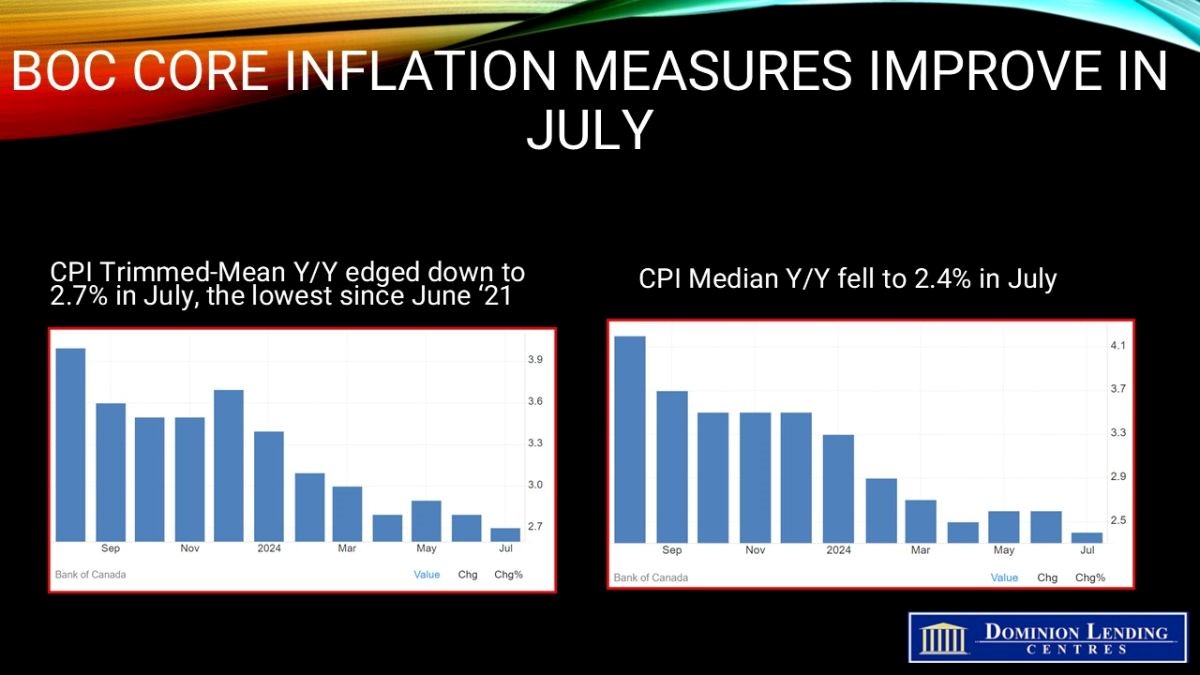

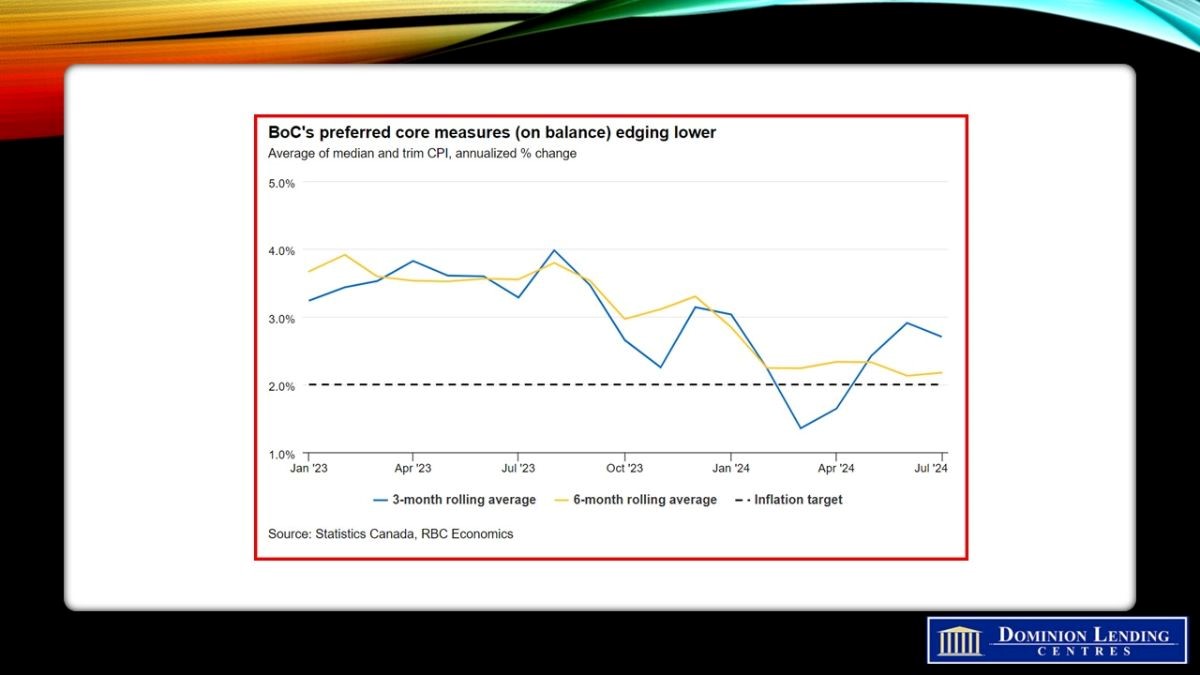

Today, the Bank of Canada cut the overnight policy rate by another 25 basis points to 4.25%. This is the third consecutive decrease since June. The Bank’s decision reflects two main developments. First, headline and core inflation have continued to ease as expected. Second, as inflation gets closer to the target, the central bank wants to see economic growth pick up to absorb the slack in the economy so inflation returns sustainably to the 2% target.

Today, the Bank of Canada cut the overnight policy rate by another 25 basis points to 4.25%. This is the third consecutive decrease since June. The Bank’s decision reflects two main developments. First, headline and core inflation have continued to ease as expected. Second, as inflation gets closer to the target, the central bank wants to see economic growth pick up to absorb the slack in the economy so inflation returns sustainably to the 2% target.

Bank of Canada has cut its policy interest rate

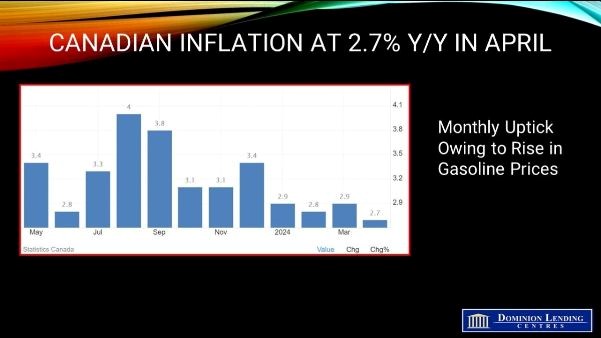

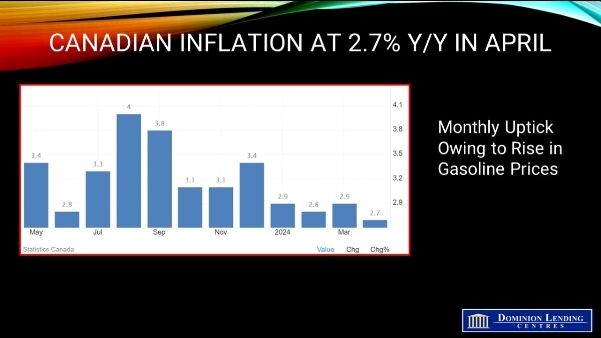

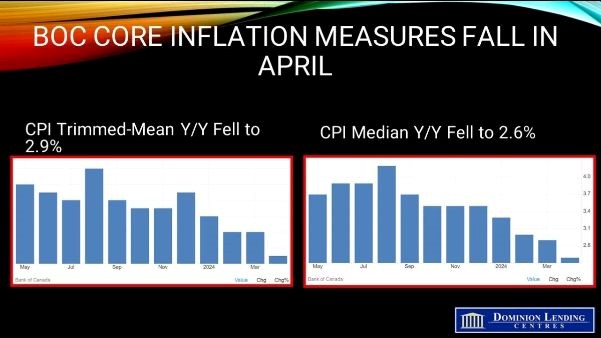

Bank of Canada has cut its policy interest rate The Consumer Price Index (CPI) rose 2.7% year-over-year (y/y) in April, down from 2.9% in March. This marks the fourth consecutive decline in core inflation. Food prices, services, and durable goods led to the broad-based deceleration in the headline CPI.

The Consumer Price Index (CPI) rose 2.7% year-over-year (y/y) in April, down from 2.9% in March. This marks the fourth consecutive decline in core inflation. Food prices, services, and durable goods led to the broad-based deceleration in the headline CPI.

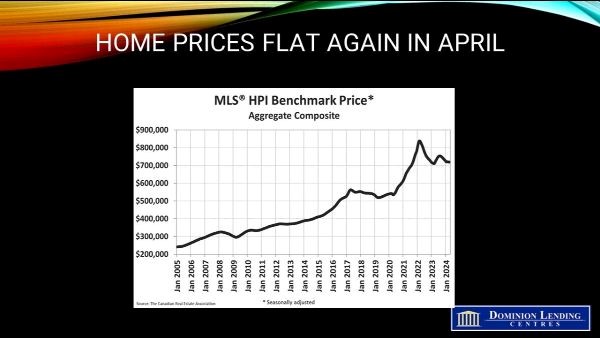

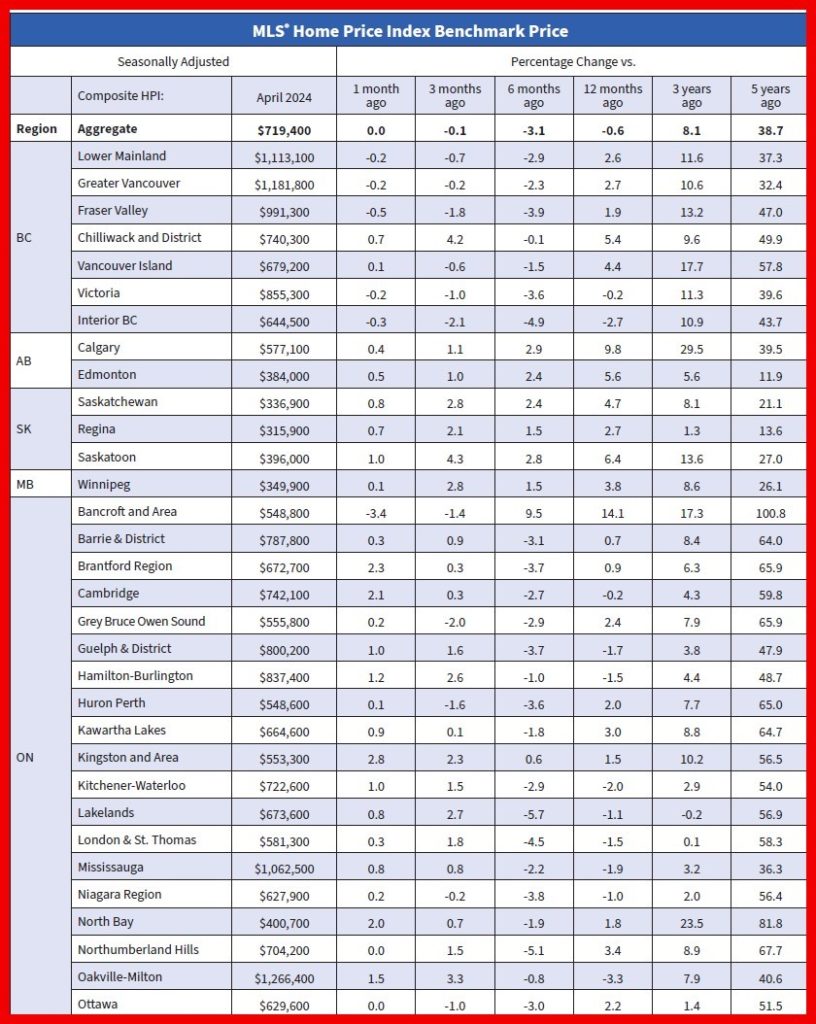

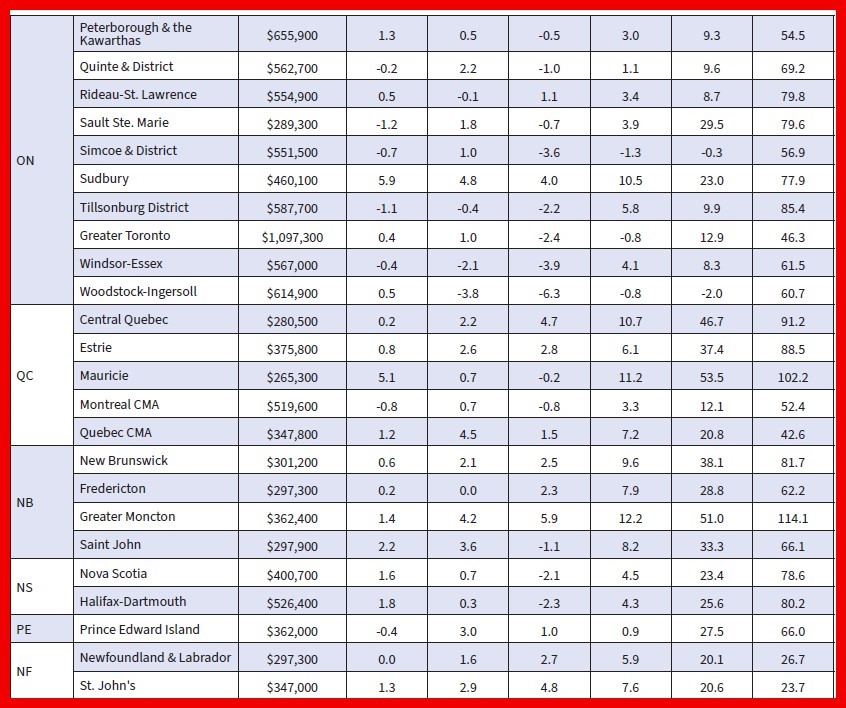

The Canadian Real Estate Association (CREA) announced today that national home sales dipped in April 2024 from its prior month, as the number of properties available for sale rose sharply to kick off the spring housing market.

The Canadian Real Estate Association (CREA) announced today that national home sales dipped in April 2024 from its prior month, as the number of properties available for sale rose sharply to kick off the spring housing market.

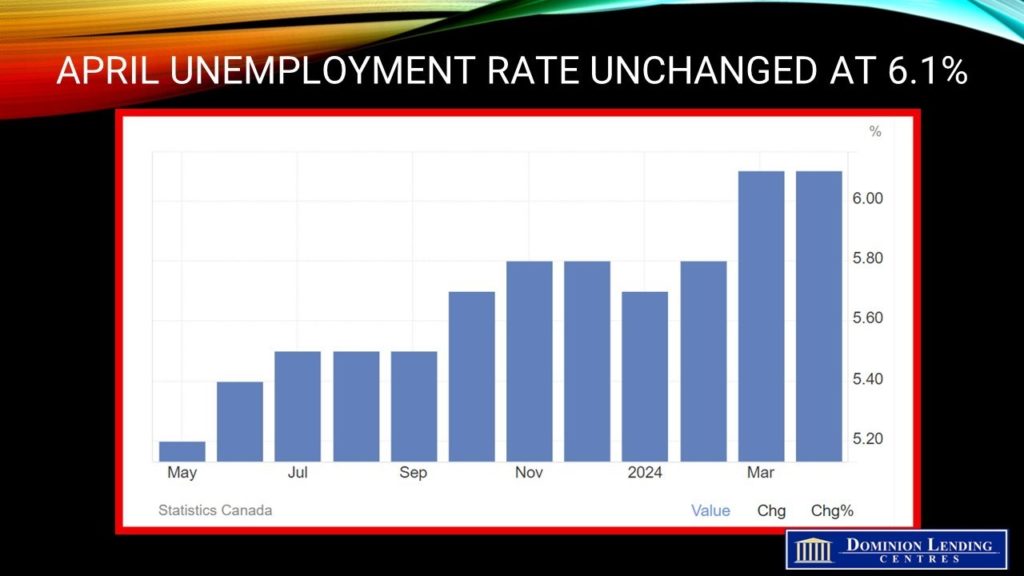

Today’s StatsCanada Labour Force Survey for April blindsided economists by coming in much more robust than expected. Employment in Canada rose a whopping 90,400 in April, the most in 15 months, following a decline in March, surpassing forecasts by a large margin. Substantial job gains were posted in both full-time and part-time work.

Today’s StatsCanada Labour Force Survey for April blindsided economists by coming in much more robust than expected. Employment in Canada rose a whopping 90,400 in April, the most in 15 months, following a decline in March, surpassing forecasts by a large margin. Substantial job gains were posted in both full-time and part-time work.