The Bank of Canada Cautious, but a Rate CUT in June is Possible

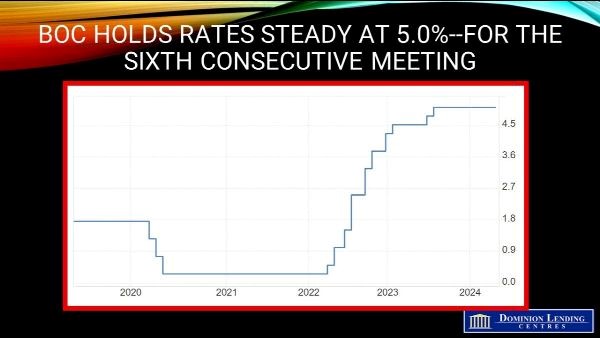

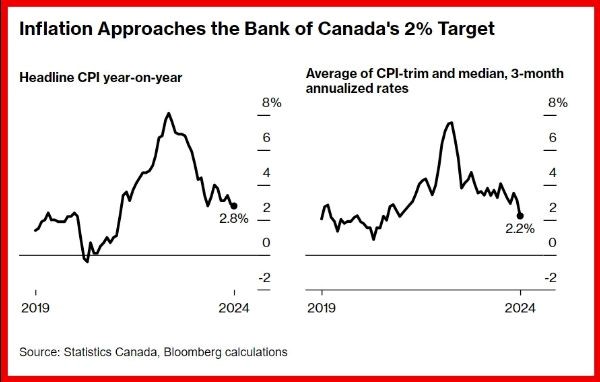

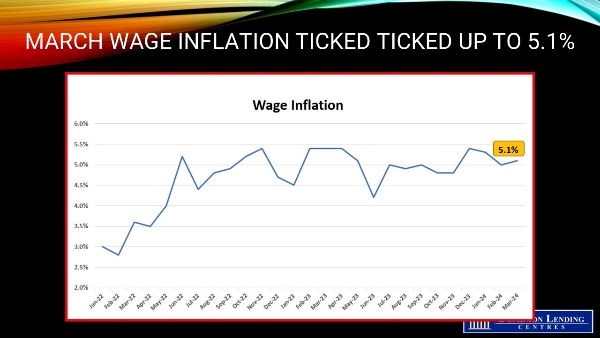

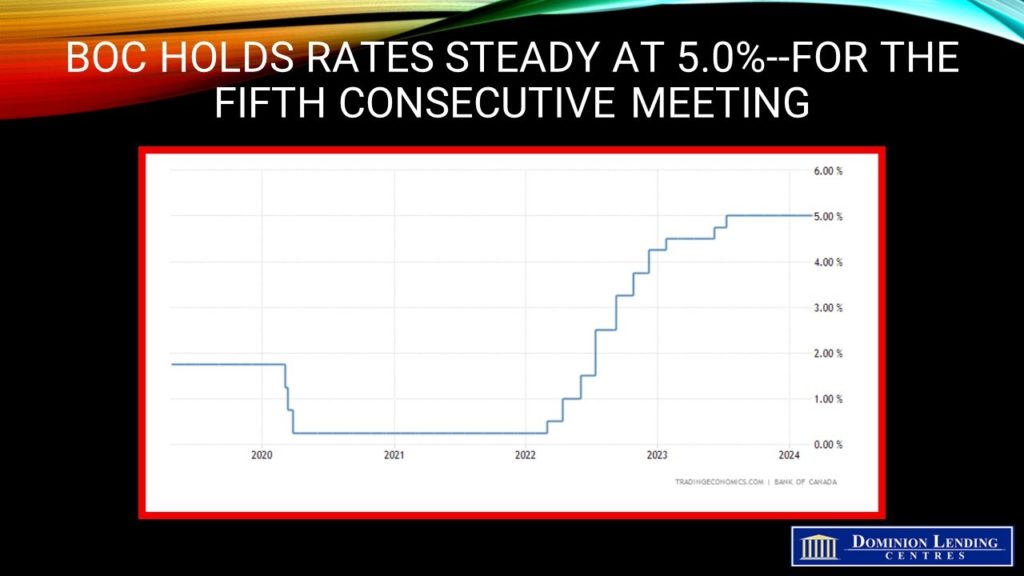

Today, the Bank of Canada held the overnight rate at 5% for the sixth consecutive meeting and pledged to continue normalizing its balance sheet. Governor Macklem confirmed that inflation is moving in the right direction, labour markets are easing, and wage pressures appear to be dissipating. In today’s release of the April Monetary Policy Report (MPR), the central bank forecasters lowered their 2024 inflation forecast to 2.6% from 2.8%. However, the Governing Council needs more evidence to be confident that the downtrend in inflation is sustainable.

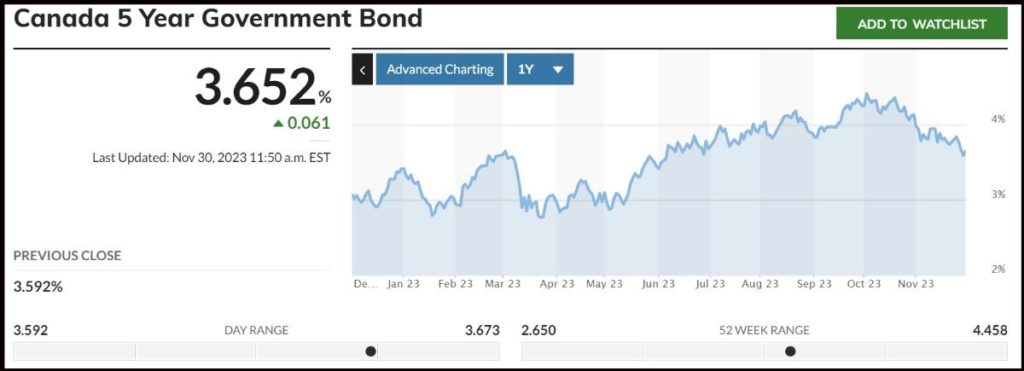

In contrast, the US CPI data released today for March showed that underlying inflation topped forecasts for the third consecutive month, and the US jobs data also beat estimates. This is in direct contrast to the news of better-than-expected inflation in Canada and the easing of labour markets. The Canadian economy is far more interest-rate sensitive than the US because mortgage terms are far shorter. Over 60% of all outstanding mortgages are up for renewal in the next two to three years, adding to monthly mortgage payments. That process has already begun.

While the Canadian economy slowed at the end of last year, more recent data suggest a bounceback in the first quarter. The Bank revised up its forecast for GDP growth in the first half of 2024 but reduced its economic outlook for next year. The Bank expects inflation to hit its 2% inflation target in 2025.

Bottom Line

Governor Macklem’s prepared opening statement at today’s press conference was more dovish on inflation than in prior months. “We are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained,” Macklem said in the prepared text. If things go according to today’s MPR forecasts, policymakers are likely to begin cutting the overnight rate in June.

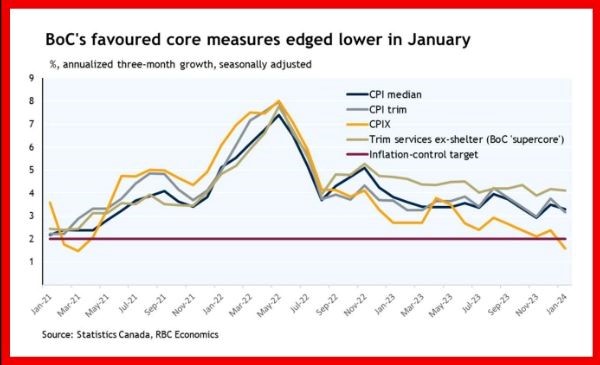

Still, Macklem called further declines in core inflation “very recent,” adding that the bank wants to “be assured this is not just a temporary dip.”

“While inflation is still too high and risks remain, CPI and core inflation have eased further in recent months,” officials said in the policy statement.

The next decision date is June 5, when overnight swaps traders pared their bets to about a 50-50 chance of a 25 basis point cut at that meeting, down from over two-thirds before today’s data release. A July rate cut is fully priced in.

We will know more this coming Tuesday when the March CPI data (along with the federal budget) are released. April CPI will be posted on May 21. As the chart below shows, inflation data in Canada is rapidly approaching the 2% target, well ahead of the US, although set backs can’t be ruled out. For example, gasoline prices have risen since early February. However, the proportion of CPI sectors showing less than 1% gains is rising as those showing more than 3% increases are falling fast.

The StatsCanada Labour Force Survey for March is much weaker than expected. Employment fell by 2,200, and the employment rate declined for the sixth consecutive month to 61.4%.

The StatsCanada Labour Force Survey for March is much weaker than expected. Employment fell by 2,200, and the employment rate declined for the sixth consecutive month to 61.4%.

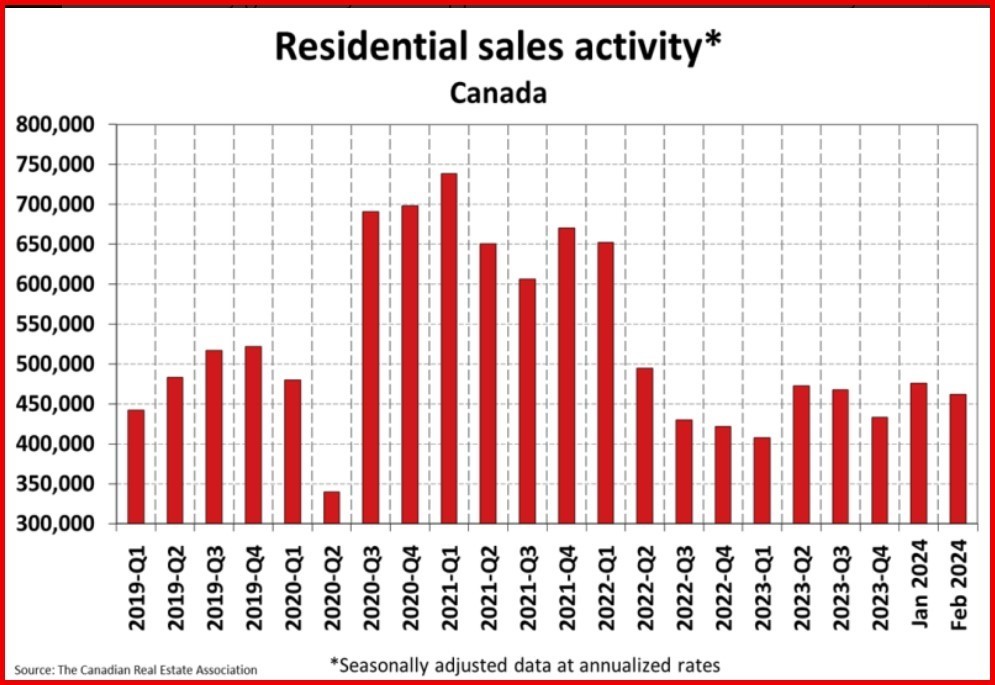

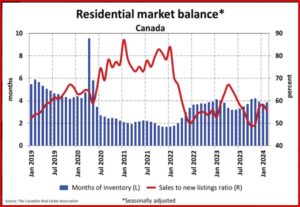

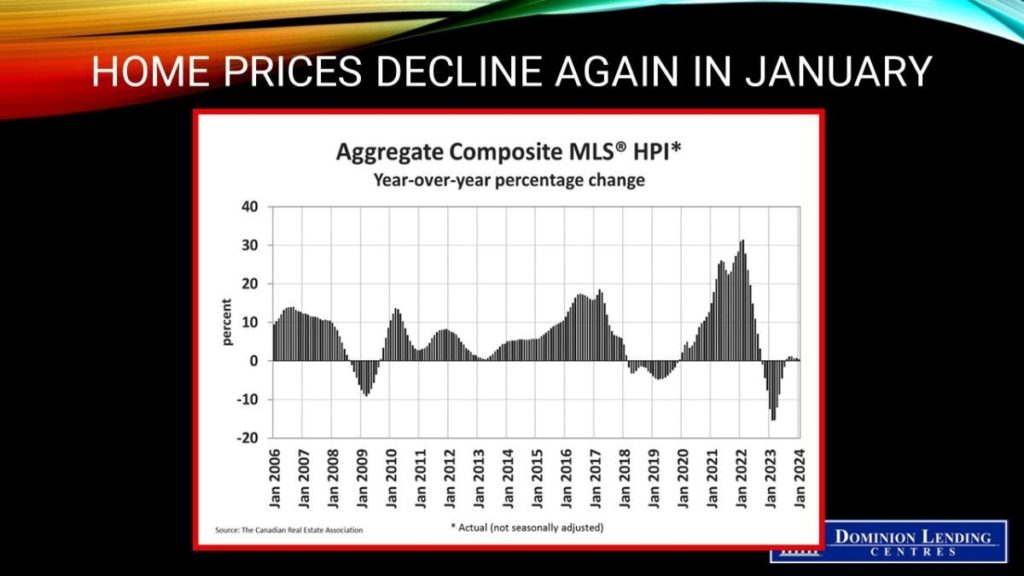

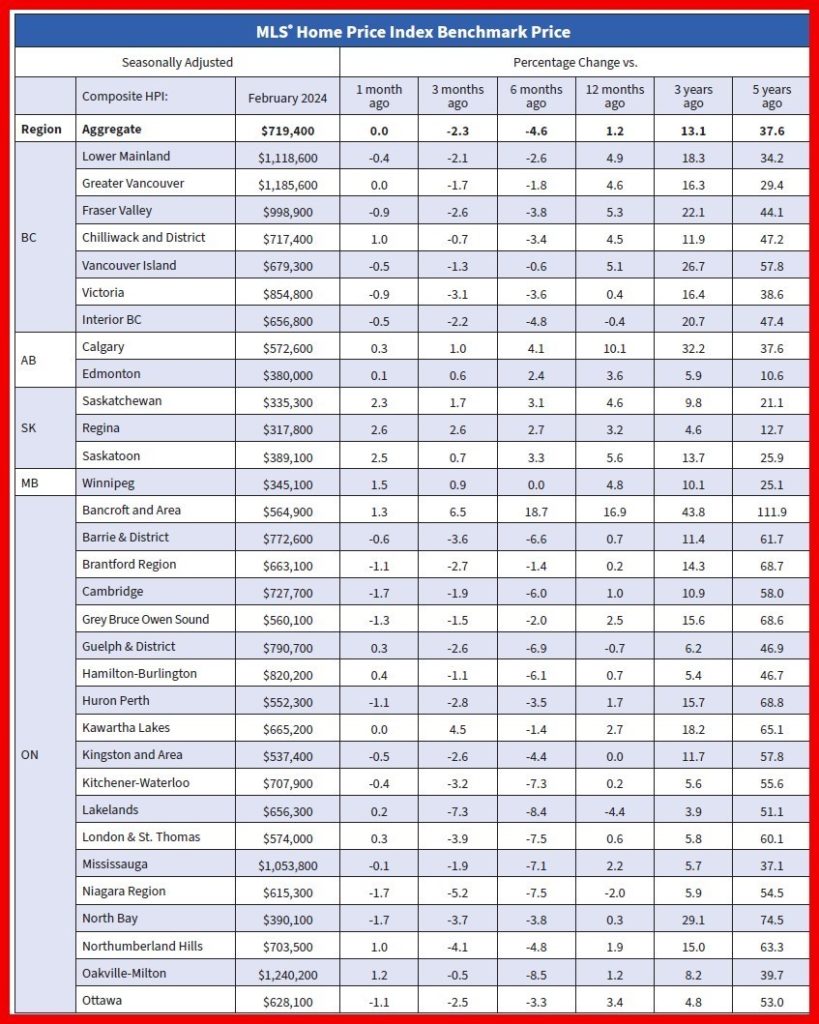

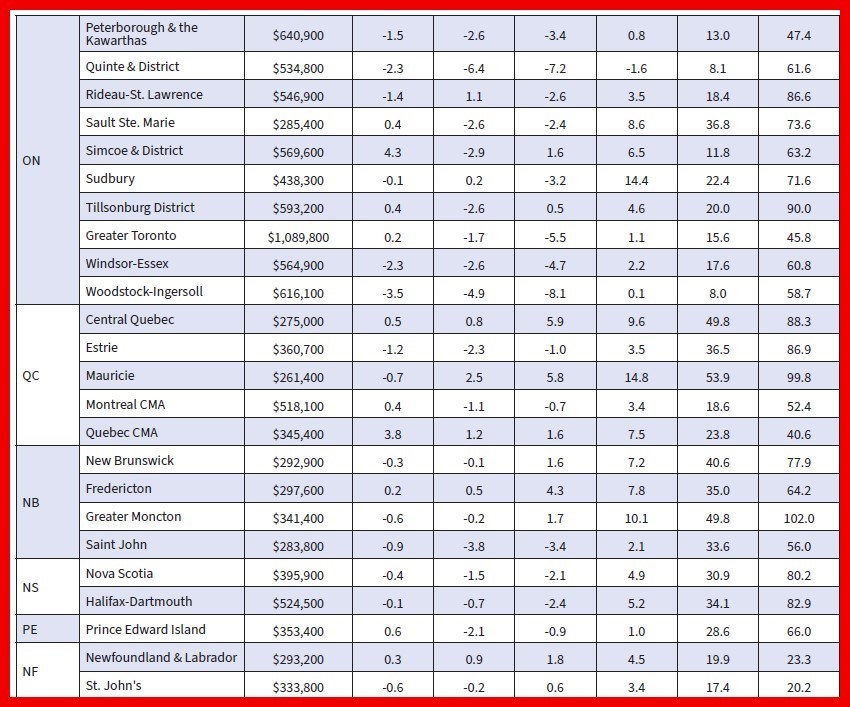

The Canadian Real Estate Association announced today that national home sales dipped 3.1% m/m in February while home prices were flat, ending a five-month price decline that began last fall.

The Canadian Real Estate Association announced today that national home sales dipped 3.1% m/m in February while home prices were flat, ending a five-month price decline that began last fall.

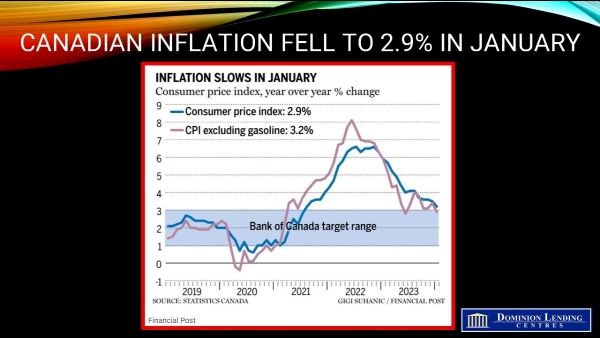

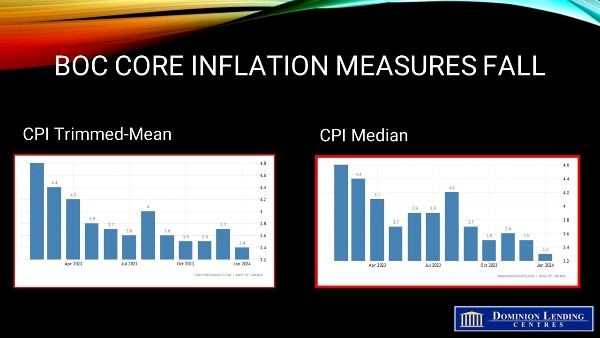

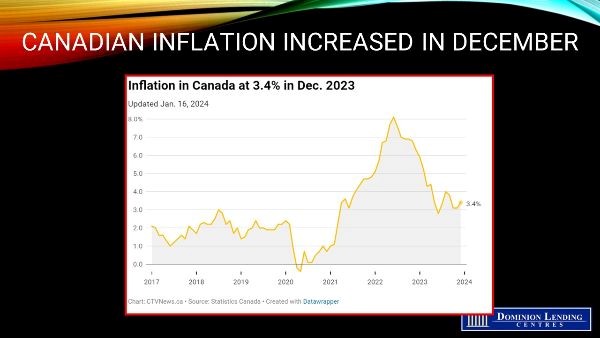

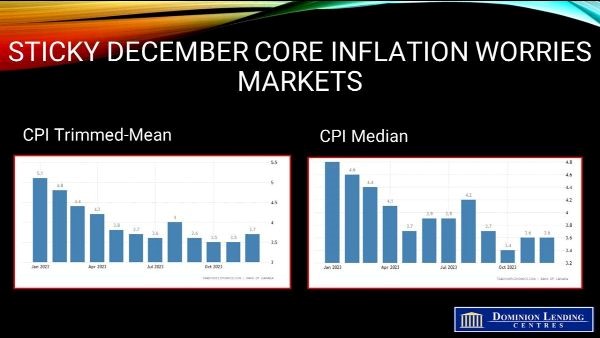

Today, the Bank of Canada held the overnight rate at 5% for the fifth consecutive meeting and pledged to continue normalizing the Bank’s balance sheet. Policymakers remain concerned about risks to the outlook for inflation. The latest data show that CPI inflation fell to 2.9% in January, but year-over-year and three-month measures of core inflation were in the 3% to 3.5% range. The Governing Council projects that inflation will remain around 3% over the first half of this year but also suggests that wage pressure may be diminishing. The likelihood is that inflation will slow more rapidly, allowing for a rate cut by mid-year.

Today, the Bank of Canada held the overnight rate at 5% for the fifth consecutive meeting and pledged to continue normalizing the Bank’s balance sheet. Policymakers remain concerned about risks to the outlook for inflation. The latest data show that CPI inflation fell to 2.9% in January, but year-over-year and three-month measures of core inflation were in the 3% to 3.5% range. The Governing Council projects that inflation will remain around 3% over the first half of this year but also suggests that wage pressure may be diminishing. The likelihood is that inflation will slow more rapidly, allowing for a rate cut by mid-year.

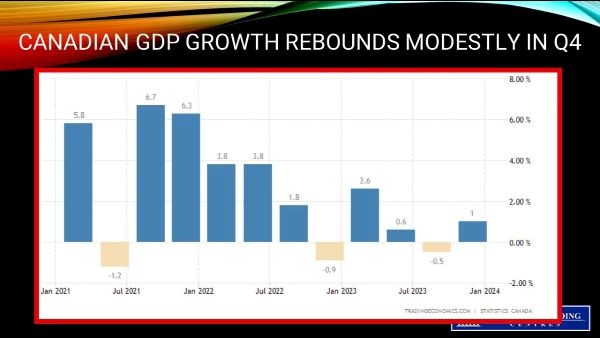

Real gross domestic product (GDP) rose a moderate 1.0% (seasonally adjusted annual rate), a tad better than expected and the Q3 contraction of -1.2% was revised to -0.5%. This leaves growth for 2023 at a moderate 1.1%. Monthly data, also released today by Statistics Canada, showed that December came in flat, well below the robust flash estimate, while the January preliminary estimate was a strong +0.4% (subject, of course, to revision). The January uptick was driven by the return of Quebec public servants and a mild winter.

Real gross domestic product (GDP) rose a moderate 1.0% (seasonally adjusted annual rate), a tad better than expected and the Q3 contraction of -1.2% was revised to -0.5%. This leaves growth for 2023 at a moderate 1.1%. Monthly data, also released today by Statistics Canada, showed that December came in flat, well below the robust flash estimate, while the January preliminary estimate was a strong +0.4% (subject, of course, to revision). The January uptick was driven by the return of Quebec public servants and a mild winter.

Canadian Inflation Falls to 2.9% in January, Boosting Rate Cut Prospects

Canadian Inflation Falls to 2.9% in January, Boosting Rate Cut Prospects

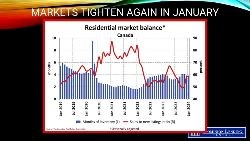

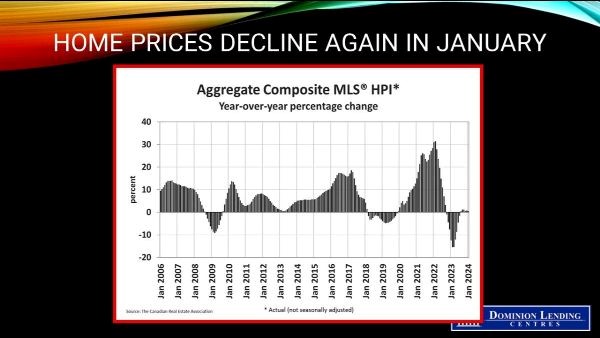

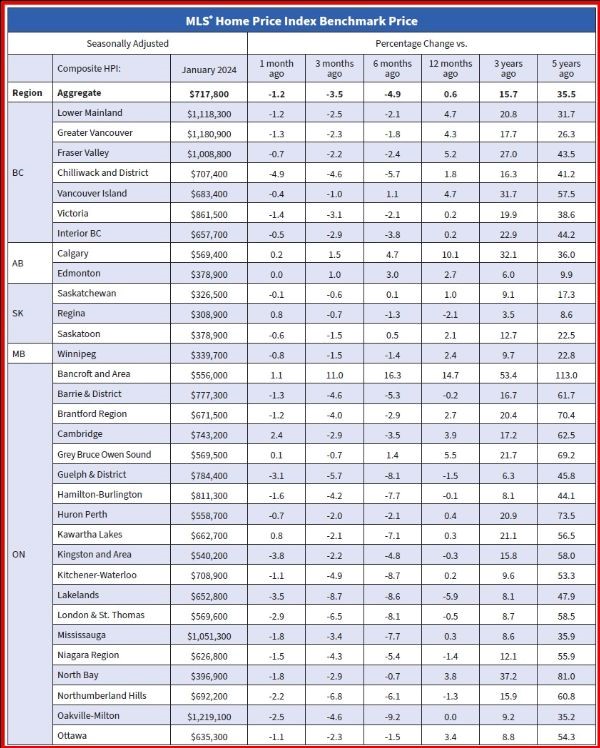

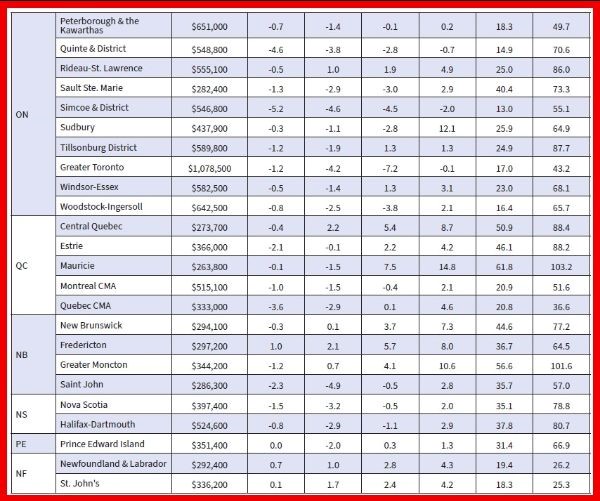

Canadian Home Sales Continued Their Upward Trend in January as Prices Fell Modestly

Canadian Home Sales Continued Their Upward Trend in January as Prices Fell Modestly

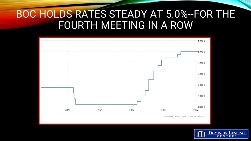

Today, The Bank of Canada held the overnight rate at 5% for the fourth consecutive meeting but provided an outlook suggesting that monetary easing will begin by mid-year. The Bank forecasts a soft landing for the Canadian economy, with inflation falling to 2.5% by the end of this year. While some economists predict a recession, the Bank suggests that “growth will likely remain close to zero through the first quarter of 2024” and “strengthen gradually around the middle of 2024.” This would be a soft landing.

Today, The Bank of Canada held the overnight rate at 5% for the fourth consecutive meeting but provided an outlook suggesting that monetary easing will begin by mid-year. The Bank forecasts a soft landing for the Canadian economy, with inflation falling to 2.5% by the end of this year. While some economists predict a recession, the Bank suggests that “growth will likely remain close to zero through the first quarter of 2024” and “strengthen gradually around the middle of 2024.” This would be a soft landing.

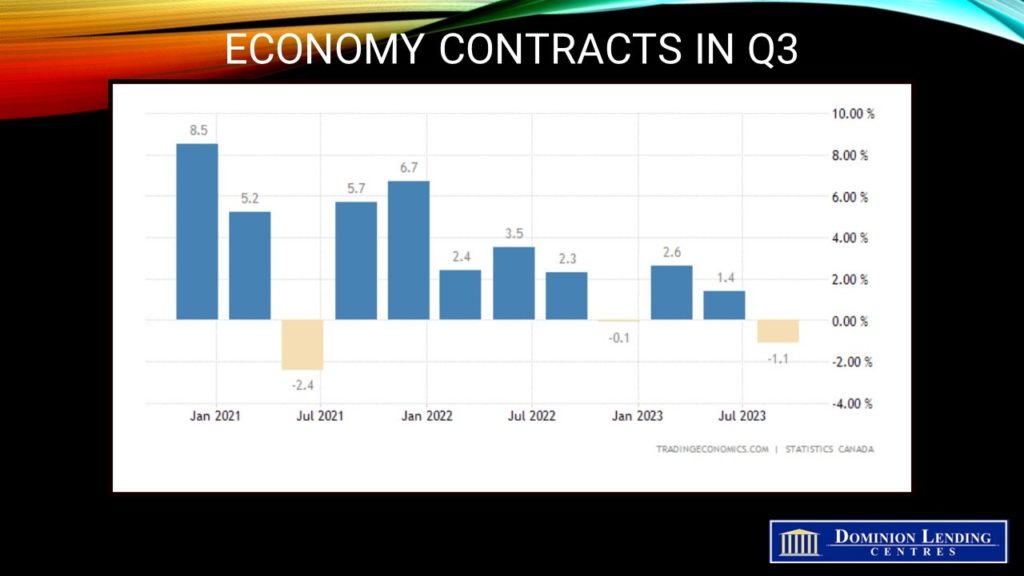

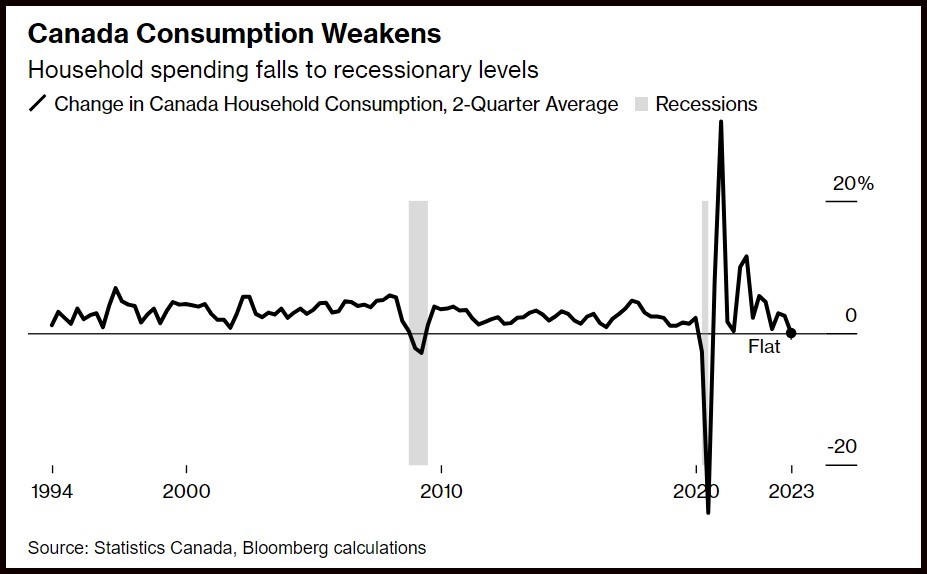

The Canadian economy weakened far more than expected in the third quarter, down 1.1% annually. However, the Q2 figures were revised up significantly from a 0.2% decline to a rise of 1.4%. Such are the vagaries of economic data. The Canadian economy is contracting despite the positive impetus of rapid population growth. Household consumer spending flatlined, and the savings rate rose, confirming that the central bank’s aggressive interest-rate hikes are doing their job to slow economic activity.

The Canadian economy weakened far more than expected in the third quarter, down 1.1% annually. However, the Q2 figures were revised up significantly from a 0.2% decline to a rise of 1.4%. Such are the vagaries of economic data. The Canadian economy is contracting despite the positive impetus of rapid population growth. Household consumer spending flatlined, and the savings rate rose, confirming that the central bank’s aggressive interest-rate hikes are doing their job to slow economic activity.