Great News on the Inflation Front

Great News on the Inflation Front

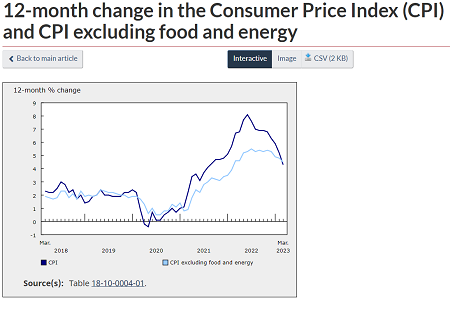

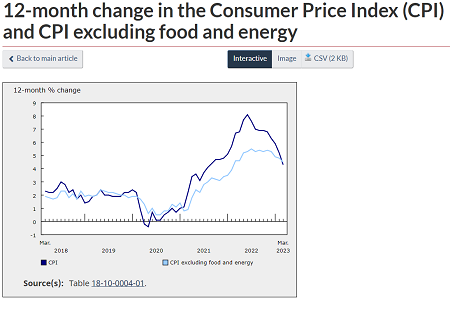

The Consumer Price Index (CPI) fell sharply in March to 4.3% year-over-year, continuing a pattern of repeated declines. Before we break out the champagne, however, much of the drop in inflation resulted from the steep monthly increase in prices in March one year ago (1.4% m/m), the so-called base-year effects.

Gasoline prices have fallen sharply since March 2022–down year-over-year by a whopping -13.8%. This was the second consecutive month in which gas prices caused inflation to fall. The fall in gasoline prices was mainly driven by steep price increases in March 2022, when gasoline rose 11.8% month-over-month due to supply uncertainty following Russia’s invasion of Ukraine. This increased crude oil prices, which pushed prices at the pump higher for Canadians. Gasoline price inflation was transitory.

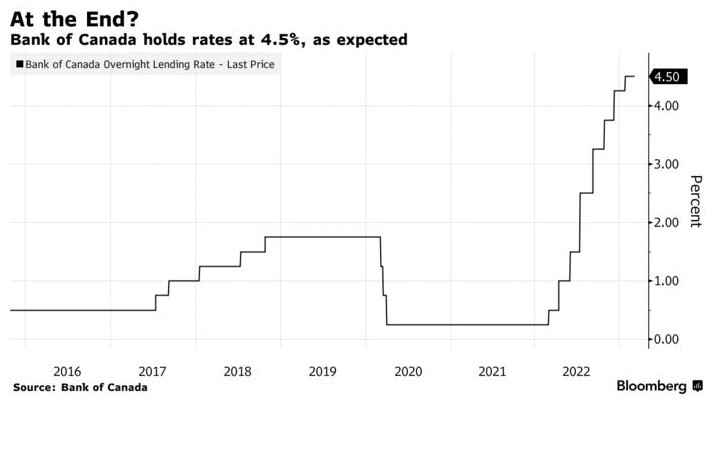

There is no question that lower inflation portends a continued rate pause by the Bank of Canada.

Inflation at 4.3% was the smallest rise since August 2021. On a year-over-year basis, Canadians paid more in mortgage interest costs, offset by a decline in energy prices.

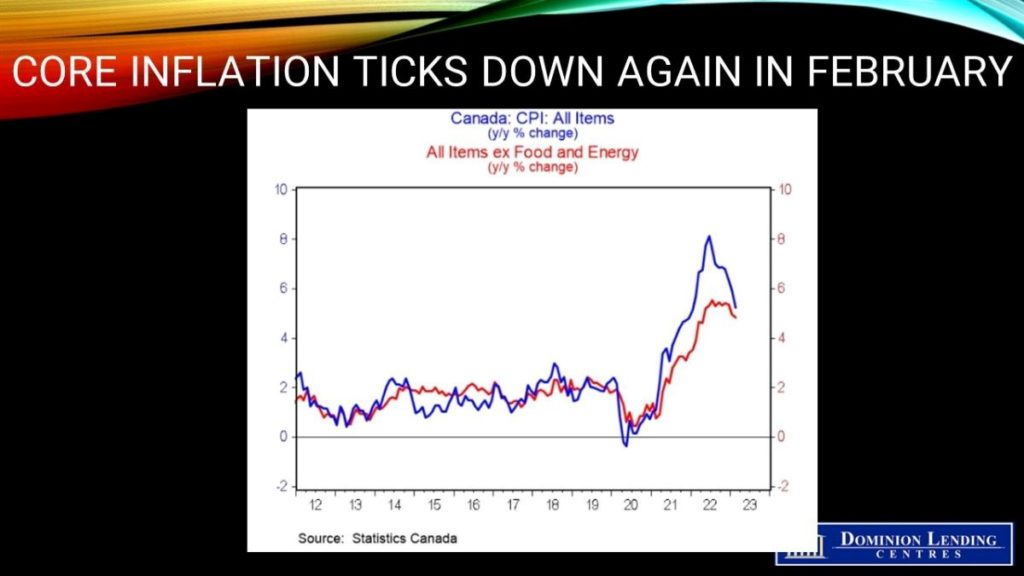

Excluding food and energy, prices were up 4.5% year over year in March, following a 4.8% gain in February, while the all-items CPI excluding mortgage interest cost rose 3.6% after increasing 4.7% in February.

Two key yearly measures tracked closely by the central bank — the so-called trim and median core rates — also dropped, averaging 4.5%, in line with forecasts.

On a monthly basis, the CPI was up 0.5% in March, following a 0.4% gain in February. Travel tours (+36.7%) contributed the most to the headline month-over-month movement, largely driven by increased seasonal demand during the March break. On a seasonally adjusted monthly basis, the CPI rose 0.1%.

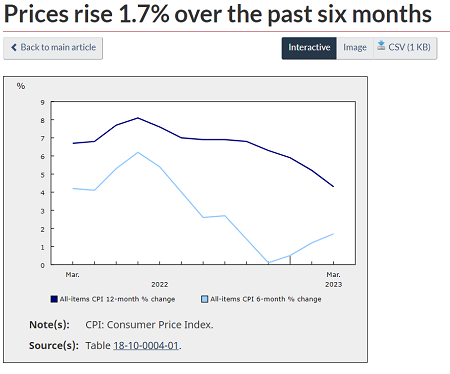

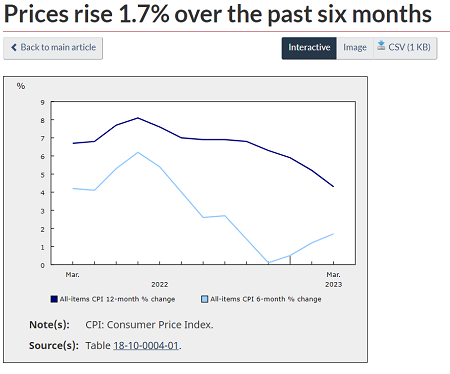

While headline inflation has slowed in recent months, having increased 1.7% in March compared with six months ago, prices remain elevated. Compared with 18 months ago, for example, inflation has increased by 8.7%.

On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was primarily due to a base-year effect, as furniture prices rose 8.2% month over month in March 2022 amid supply chain issues.

On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was primarily due to a base-year effect, as furniture prices rose 8.2% month over month in March 2022 amid supply chain issues.

Prices for passenger vehicles also contributed to the deceleration in prices for durable goods, increasing at a slower pace year over year in March 2023 (+4.7%) compared with February (+5.3%). Higher prices for passenger vehicles in March 2022, due to the global shortage of semiconductor chips, put downward pressure on the index in March 2023.

Month over month, new passenger vehicle prices were up 1.3% in March, attributable to the higher availability of new 2023-model-year vehicles. For comparison, prices for used cars rose 0.6% month over month in March, after a 1.9% decline in February.

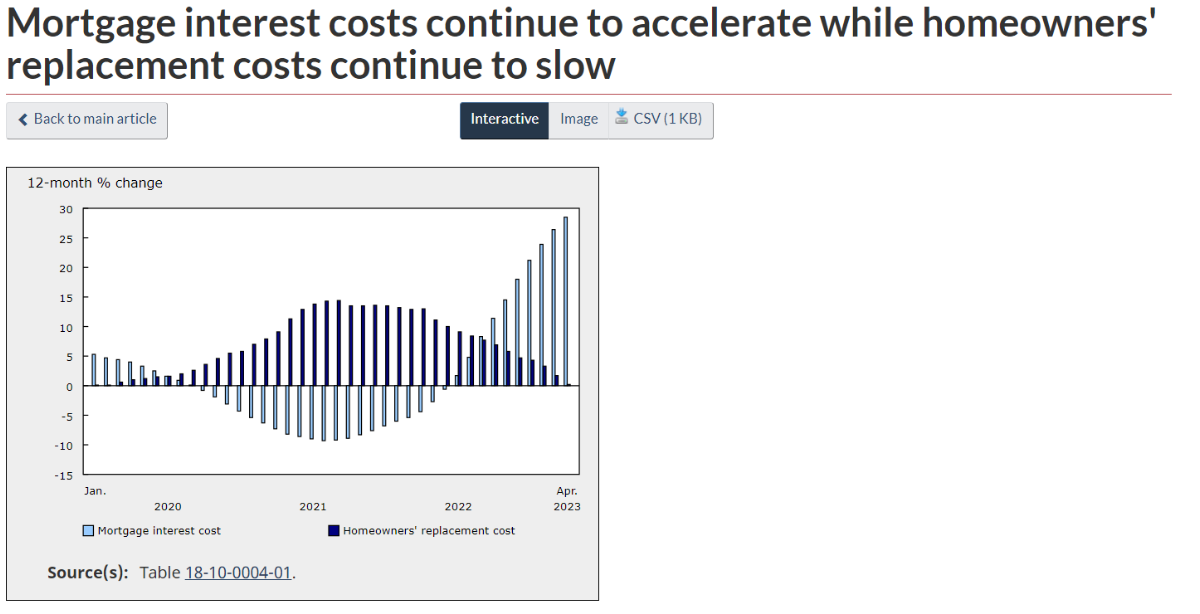

Homeowners’ replacement costs continued to slow in March, rising 1.7% year over year compared with a 3.3% increase in February, reflecting a general cooling of the housing market.

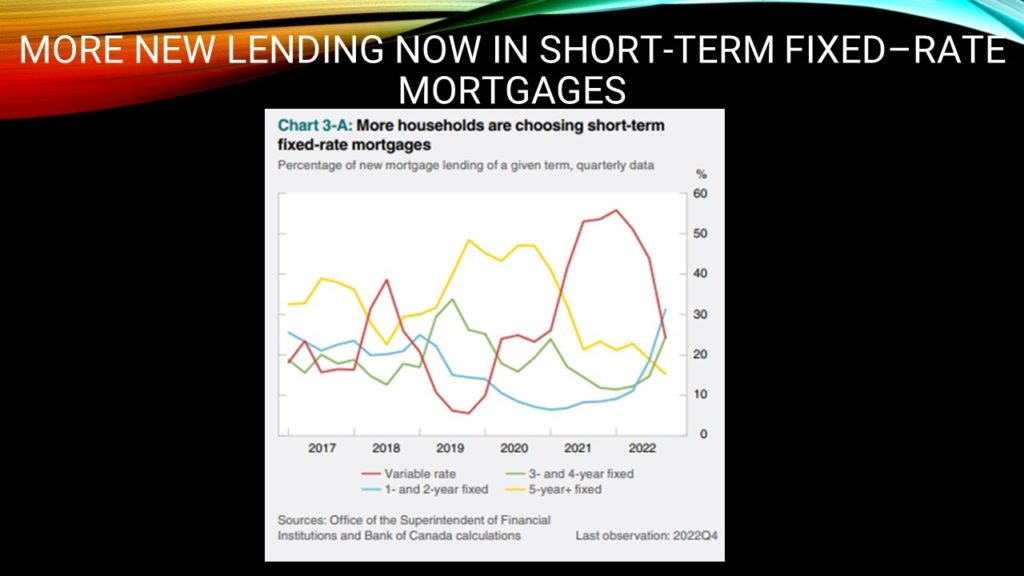

In contrast, mortgage interest costs rose faster in March (+26.4%) compared with February (+23.9%). This was the most significant yearly increase on record as Canadians continued to renew and initiate mortgages at higher interest rates.

There has finally been some relief in grocery price inflation. Year over year, prices for food purchased from stores rose to a lesser extent in March (+9.7%) than in February (+10.6%), with the slowdown stemming from lower prices for fresh fruit and vegetables.

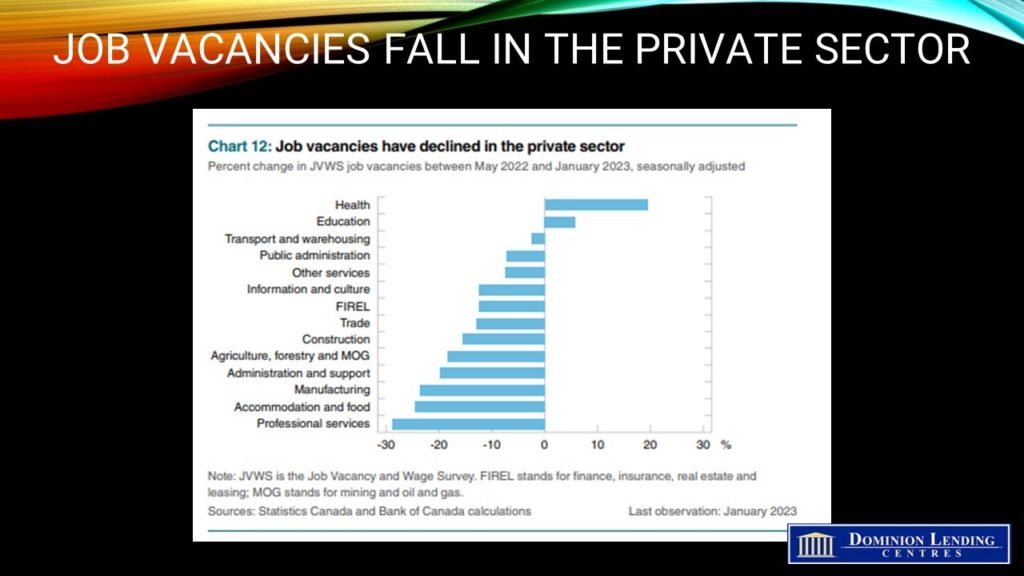

Service inflation slowed to 5.1% in March. But in a sign wage pressures could be picking up, more than 155,000 federal workers are set to go on strike starting Wednesday if no deal is reached on their talks with Prime Minister Justin Trudeau’s government by Tuesday night.

Bottom Line

Bottom Line

The Bank of Canada is no doubt delighted that inflation continues to cool. The Bank expects price gains to reach 3% by midyear and return to near their 2% target by the end of 2024. But they said getting the prices back to 2% could prove more difficult because inflation expectations are coming down slowly, and service prices and wage growth remain elevated.

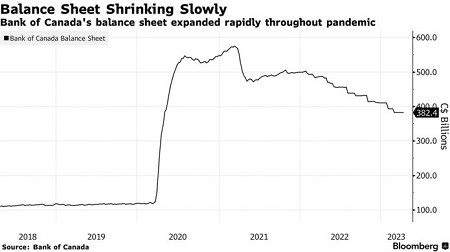

Governor Tiff Macklem, speaking at the IMF and World Bank meetings in Washington recently, said the Bank of Canada is prepared to end quantitative tightening earlier than planned if the economy needs stimulation. Quantitative tightening is the selling of government bonds on the Bank’s balance sheet, which takes money out of the economy.

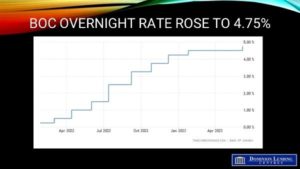

Macklem said his officials discussed hiking rates further during deliberations for the April 12th decision to continue to pause and reiterated that “it is far too early to be thinking about cutting interest rates.”

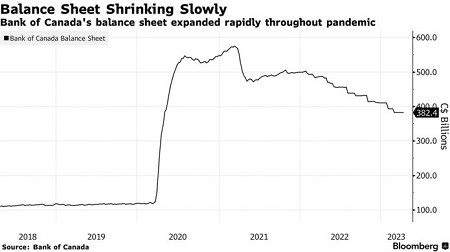

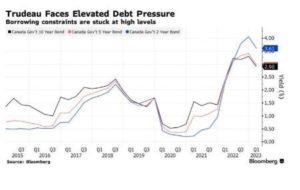

His comments provide a glimpse into the Bank of Canada’s strategy for shrinking its balance sheet, which ballooned to more than $570 billion during the pandemic as it bought large quantities of government bonds — to restore market functioning during the initial Covid shock and then to provide a stimulus for the economy.

The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

According to Bloomberg News, swaps traders are now betting the Bank of Canada’s next move will be a cut later this year. The governor pushed back on those expectations in a press conference this week. He and his officials discussed the possibility that rates need “to remain restrictive for longer to get inflation all the way back to target.”

In a speech last month, Deputy Governor Toni Gravelle said quantitative tightening will likely end in late 2024 or early 2025. That marked the first time the Bank of Canada put a date on abandoning the program.

Dr. Sherry Cooper | Chief Economist, Dominion Lending Centres

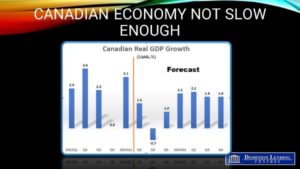

The next Bank of Canada decision date is a mere five weeks away. While we will see two labour force surveys and one inflation report, the odds favour another rate hike before yearend. The BoC concluded in their press release that, “Overall, excess demand in the economy looks to be more persistent than anticipated.”

The next Bank of Canada decision date is a mere five weeks away. While we will see two labour force surveys and one inflation report, the odds favour another rate hike before yearend. The BoC concluded in their press release that, “Overall, excess demand in the economy looks to be more persistent than anticipated.”

Good News is Bad News for the Bank of Canada

Good News is Bad News for the Bank of Canada One warning sign is the declining household savings rates and slower disposable income. Persistently high interest rates had a predominantly negative effect on net property income, as increases in interest income (+6.4%), mainly from deposits, did not keep pace with higher interest payments on mortgages (+14.7%) and consumer credit (+10.9%).

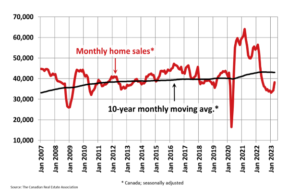

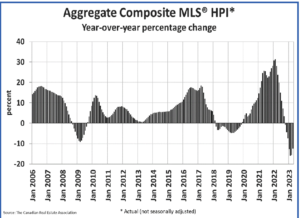

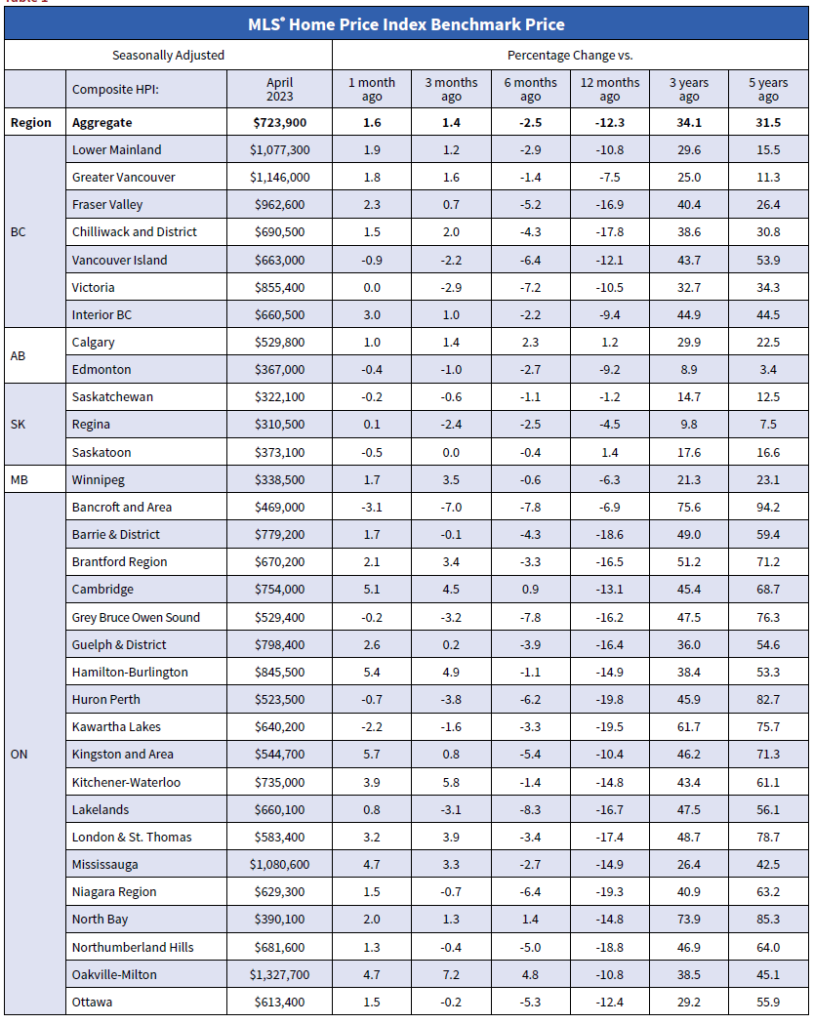

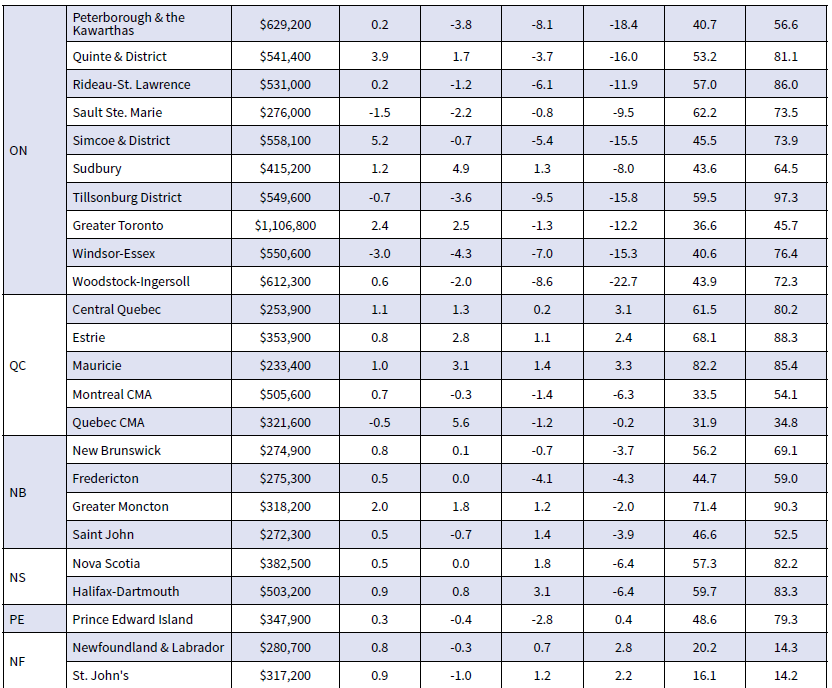

One warning sign is the declining household savings rates and slower disposable income. Persistently high interest rates had a predominantly negative effect on net property income, as increases in interest income (+6.4%), mainly from deposits, did not keep pace with higher interest payments on mortgages (+14.7%) and consumer credit (+10.9%). The Canadian Real Estate Association says home sales in April surged 11.3% month-over-month. The Spring rebound was on the heels of smaller back-to-back gains in the prior two months. Now that the Bank of Canada paused interest rate hikes and home prices in most regions have softened, homebuyers are scrambling for the minimal available housing supply.

The Canadian Real Estate Association says home sales in April surged 11.3% month-over-month. The Spring rebound was on the heels of smaller back-to-back gains in the prior two months. Now that the Bank of Canada paused interest rate hikes and home prices in most regions have softened, homebuyers are scrambling for the minimal available housing supply.

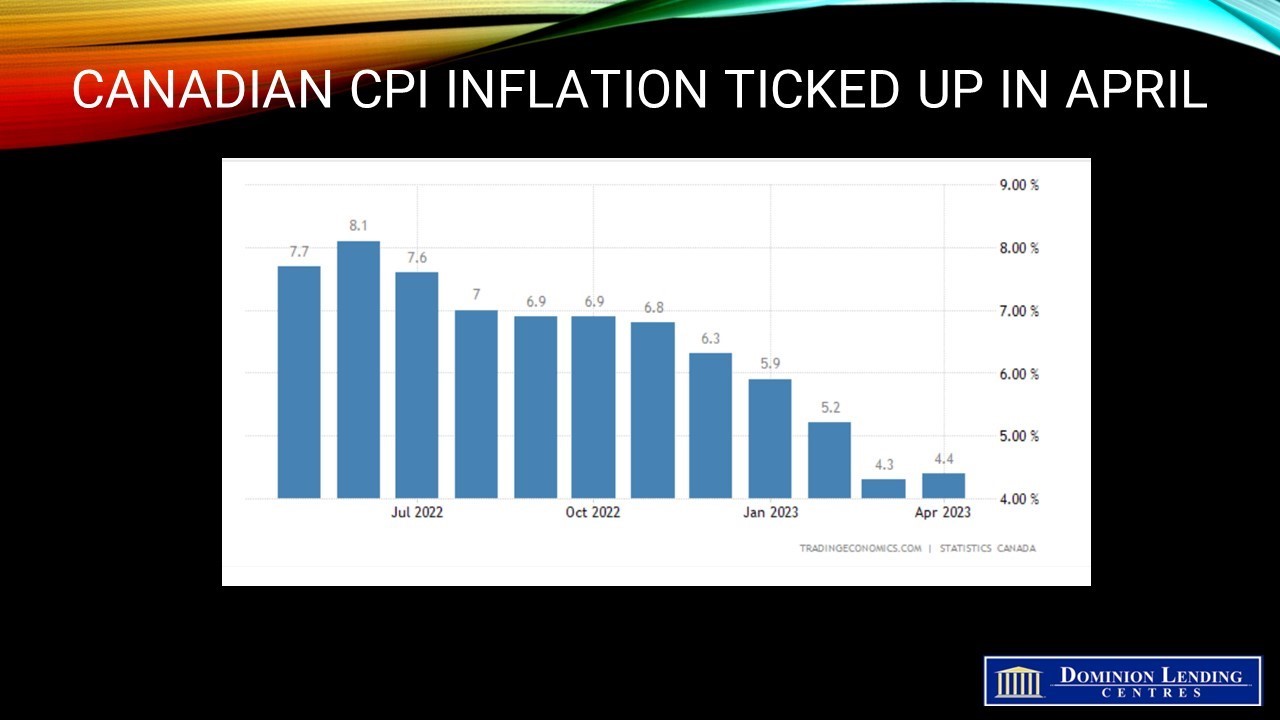

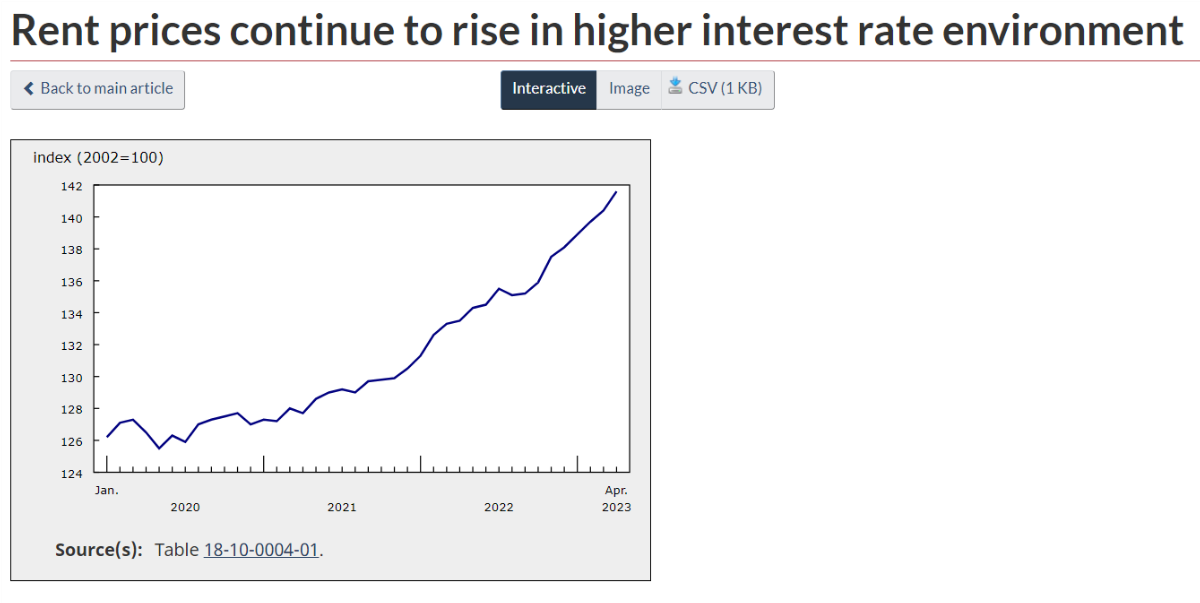

There’s been an unexpected hiccup in the Bank of Canada’s ongoing battle against inflation. Year-over-year, price pressures escalated to 4.4% in April, an uptick from the previous month’s 4.3% and significantly exceeding the average economist’s prediction of 4.1%. This marks the first rise in overall inflation from the last June. Ironically, higher interest rates are intended to tackle inflation, but rising rent prices and mortgage interest costs contributed the most to the all-items CPI increase last month.

There’s been an unexpected hiccup in the Bank of Canada’s ongoing battle against inflation. Year-over-year, price pressures escalated to 4.4% in April, an uptick from the previous month’s 4.3% and significantly exceeding the average economist’s prediction of 4.1%. This marks the first rise in overall inflation from the last June. Ironically, higher interest rates are intended to tackle inflation, but rising rent prices and mortgage interest costs contributed the most to the all-items CPI increase last month.

On April 18, Canada’s national banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), released its second Annual Risk Outlook (ARO), outlining what it believes are the most significant headwinds facing the Canadian financial system – and what the regulator plans on doing about it.

On April 18, Canada’s national banking regulator, the Office of the Superintendent of Financial Institutions (OSFI), released its second Annual Risk Outlook (ARO), outlining what it believes are the most significant headwinds facing the Canadian financial system – and what the regulator plans on doing about it. Great News on the Inflation Front

Great News on the Inflation Front On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was primarily due to a base-year effect, as furniture prices rose 8.2% month over month in March 2022 amid supply chain issues.

On a year-over-year basis, price growth for durable goods slowed in March (+1.6%) compared with February (+3.4%). Furniture prices led the deceleration in prices for durable goods, falling 0.3% year over year in March, following a 7.2% increase in February. The decline was primarily due to a base-year effect, as furniture prices rose 8.2% month over month in March 2022 amid supply chain issues. Bottom Line

Bottom Line The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

The remarks show an acknowledgment among policymakers that their plans could shift if there’s a negative economic shock that requires a loosening of monetary policy.

The Bank of Canada upgraded its growth projections for this year in a new forecast, suggesting the odds of a soft landing have increased. This may preclude interest rate cuts this year.

The Bank of Canada upgraded its growth projections for this year in a new forecast, suggesting the odds of a soft landing have increased. This may preclude interest rate cuts this year. This morning’s Jobs Report was again solid. Job creation, though more tempered than in earlier months, is still robust. The unemployment rate remained at 5.0% for the fourth consecutive month. Very troubling to the Bank of Canada was the wage inflation, still above 5%.

This morning’s Jobs Report was again solid. Job creation, though more tempered than in earlier months, is still robust. The unemployment rate remained at 5.0% for the fourth consecutive month. Very troubling to the Bank of Canada was the wage inflation, still above 5%.

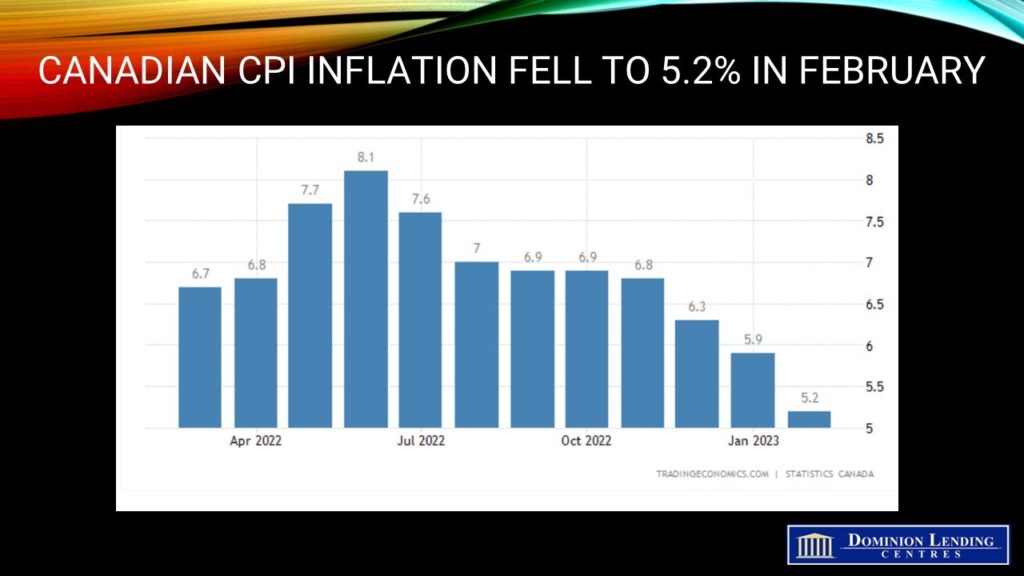

Further Decline in Inflation in February Will Keep the Bank of Canada on Hold in April

Further Decline in Inflation in February Will Keep the Bank of Canada on Hold in April